bachkim24h.com, Jakarta Meski namanya tak sering terdengar di telinga masyarakat, namun sosok perempuan yang satu ini tak bisa dianggap enteng. Lihat saja saat dilantik sebagai Guru Besar Tetap Bidang Pulmonologi dan Kedokteran Respirasi Fakultas Kedokteran Universitas Indonesia (FK-UI), Sabtu 17 Februari 2024, beberapa tokoh pun turut hadir memberikan penghormatan.

Setidaknya Menteri Kesehatan RI Budi Gunadi Sadikin, mantan Menteri Koordinator Politik, Hukum dan Keamanan Mahfud Md serta mantan Duta Besar DKI Jakarta Anies Baswedan hadir mendengarkan Prof. dr. dr. Erlina Burhan, SpP(K), M.Si. membacakan sambutan pembukaannya dalam acara yang dipimpin oleh Rektor UI, Prof. Ari Kuncoro, S.E., M.A., Ph.D.

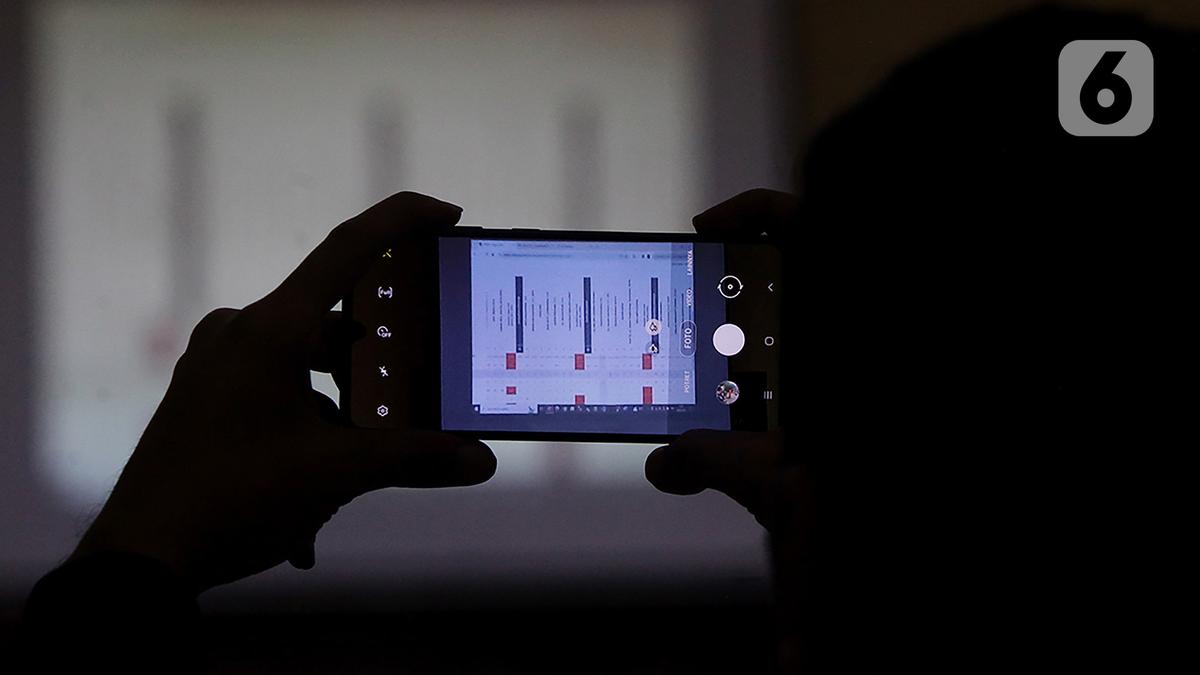

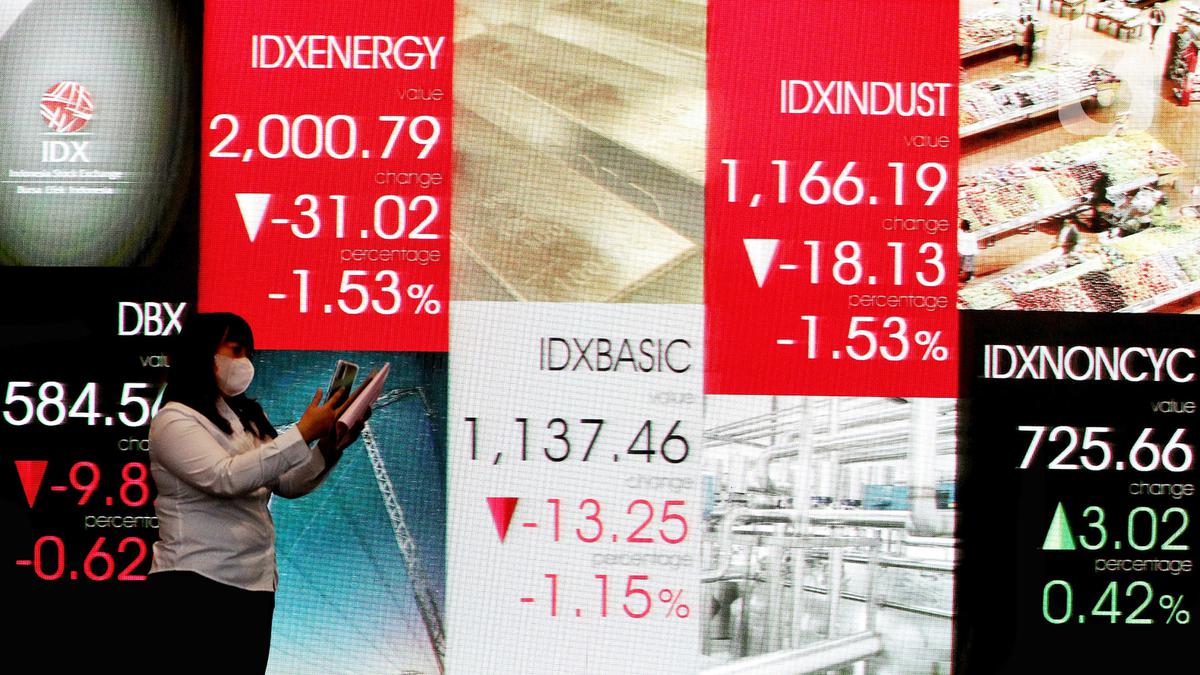

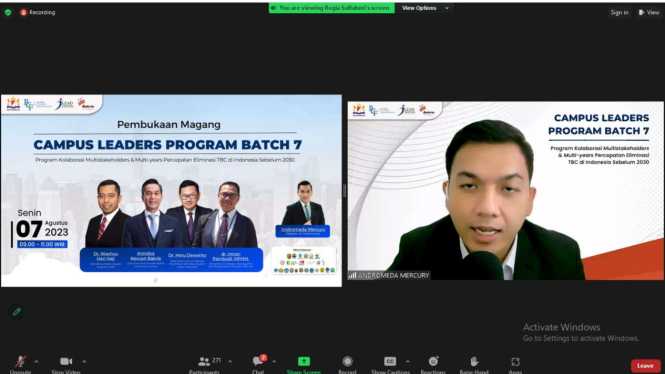

Dalam kuliah umum bertajuk “Orkestrasi Menuju Eliminasi TBC di Indonesia pada Tahun 2030”, Erlina menyoroti penyakit TBC di Indonesia yang semakin meningkat dari tahun ke tahun. Menurut Laporan TBC Global WHO, terdapat 834.000 kasus baru di Indonesia pada tahun 2010, meningkat menjadi 842.000 pada tahun 2019 dan meningkat menjadi 1.060.000 kasus pada tahun 2022.

Erlina Burhan merupakan dosen FK-UI spesialisasi pulmonologi kelahiran Padang, Sumatera Barat pada tanggal 15 Mei 1966. Beliau menyelesaikan studi kedokteran di Universitas Andlas, Padang pada tahun 1989 dan melanjutkan studi di Universitas Heidelberg, Jerman. Gelar Master of Science pada tahun 1995.

Pada tahun 2004, ia mendapat gelar sarjana ilmu paru dari UI dan setahun kemudian Erlina menjadi pengajar di FK-UI hingga sekarang. Dedikasinya sebagai guru pun mengantarkan Erlina meraih gelar Konseling (Sp. P(K)) bidang penyakit paru-paru pada tahun 2010. Akhirnya pada tahun 2012 ia mampu memperoleh gelar doktor dari UI.

Sebagai seorang guru, Erlina terkenal dengan keramahannya. Mereka sering meminta siswa untuk berkontribusi langsung pada proyek ilmiah. Sebaliknya, ia juga mengenalkan murid-muridnya pada ilmu statistika dan berbagai ilmu pengetahuan pakar.

Selain menjadi guru, Erlina juga bekerja sebagai Kepala Divisi Infeksi Departemen Pulmonologi dan Kedokteran Respirasi FK-UI. Tidak hanya itu, mereka juga sangat aktif dalam berbagai penelitian dan banyak menghasilkan publikasi ilmiah, nasional dan internasional.

Erlina juga pernah bergabung di beberapa organisasi, seperti Koalisi Organisasi Profesional Tuberkulosis (TB) sebagai ketua ahli, Ketua Majelis TB Asia Pacific Respirology Society sejak -2017 hingga saat ini, anggota Organisasi Kesehatan Dunia (WHO) pedoman. kelompok pengembangan dan dengan American Thoracic Society, Erlina juga mengembangkan pedoman internasional untuk pengobatan TBC.

Di masa pandemi Covid-19, Erlina aktif memberikan edukasi dan informasi kepada masyarakat melalui berbagai sarana komunikasi. Ia juga melakukan penelitian terhadap Covid-19, uji klinis dan nonklinis.

Selama bekerja di berbagai rumah sakit di Jakarta, Erlina yang pernah menjabat Ketua Persatuan Dokter Paru Indonesia (PDPI) Jakarta periode 2015-2020 ini mengaku tak punya cukup waktu untuk mendampingi anak-anaknya belajar di rumah karena ia harus bekerja di rumah sakit ketika wabah datang.

Sebagai apresiasi atas kontribusinya tersebut, ia mendapatkan beberapa penghargaan, salah satunya adalah Tokoh Perubahan Republik Tahun 2020 yang diberikan langsung kepada Menteri Kesehatan, Budi Gunadi Sadikin.

Lantas, apa saja kelebihan Erlina setelah menjadi Guru Besar UI dan semakin sedikit kesempatan bertemu keluarga?

Berikut cuplikan perbincangan Erlina Burhan dan Sheila Octarina di acara Bincang Liputan6.

Apakah cita-cita Prof menjadi dokter dan guru jika ada di sini?

Dulu ketika saya masih di sekolah, kami biasa menulis memoar. Nah, biasanya di dalam buku kamu menuliskan nama, alamat, minat, dan terakhir tujuanmu. Dan saat itu saya ingat, ketika saya masih SD, saya pernah mendaftar menjadi dokter. Saya rasa hampir semua dari kita bermimpi menjadi seorang dokter.

Mungkin yang menulis artikel ini adalah seorang pilot atau tentara. Wanita biasa adalah seorang dokter. Tidak ada seorang pun yang ingin menjadi ibu rumah tangga, tidak ada yang namanya menulis. Saat SMA, kami sering melanjutkan kebiasaan lama kami, menulis buku seperti ini. Apa nama buku kenangannya? Kemudian mintalah satu sama lain untuk menyelesaikan hal berikut. Saya juga terkejut dokter terus menulis. Bahkan siswa SMA pun seperti itu, begitu pula dokter.

Mungkin saat menuliskan kata-kata dokter itu juga bisa menjadi doa ya?

Mungkin ya, mungkin.

Dari mimpi hingga akhirnya menjadi pekerjaan?

Ya, seiring berjalannya waktu dan secara tidak sengaja saat aku masih SD, SMP, dan SMA, nilaiku sangat bagus, sehingga ketika aku mengikuti ujian masuk perguruan tinggi aku diterima. Dan saya adalah tipe orang yang menganggap segala sesuatunya serius dan mempunyai keinginan untuk mencapainya.

Mengapa memilih dokter paru?

Oh, sebenarnya aku tidak memilih itu. Jadi kalau di rumah sakit umum, dulu kalau lulusan kedokteran harus masuk rumah sakit umum selama tiga tahun. Lalu saya mendapat informasi, ada beasiswa DAAD. Dan salah satu dari mereka mengatakan itu untuk dokter.

Dan sekolahnya di Jerman, Heidelberg karena DAAD merupakan beasiswa dari pemerintah Jerman. Kemudian saya melamar dan bersyukur kepada Tuhan karena telah menerima saya dan setelah saya keluar dari rumah sakit, saya menikah terlebih dahulu, kemudian saya berangkat ke Jerman.

Itu artinya gelar master, kan?

S2 adalah. Jadi masterku di bidang kesehatan masyarakat. Nah, yang menarik adalah program tersebut mengharuskan kita melakukan penelitian untuk tugas akhir kita, dan persyaratan penelitiannya bagus. Melakukan penelitian tidak diperbolehkan di Jerman, tidak diperbolehkan di negara asal Anda.

Jadi saya berpikir lagi, kira-kira penelitiannya dimana? Saya pikir saya ingin menjelajahi tempat yang belum pernah saya kunjungi sebelumnya. Saya berada di Amerika karena saat SMA saya mengikuti program AFS yaitu program pertukaran di SMA. Juga di Jerman sekolah berlangsung hingga Jumat, Sabtu dan Minggu dan Anda dapat pergi ke negara lain.

Tapi menurut saya itu mudah dilakukan, jadi jangan sampai negara-negara di sekitar Jerman seperti itu. Ketika saya mencoba pergi ke daratan Australia, saya pun menjadi teman selama enam bulan. Saya belum pernah ke Afrika, itu benar.

Lalu saya bertanya kepada organisasi tersebut, di Afrika, apakah ada kursus atau proyek yang bisa saya ikuti? Ternyata jujur saja di Namibia yang dekat dengan Afrika Selatan. Dan kebetulan saat itu saya bisa meneliti TBC.

Saat itu, kami menyelidiki mengapa beberapa pasien tuberkulosis tidak menyelesaikan pengobatan hingga sembuh. Jadi saya mewawancarai pasien, keluarga, dan pejabat. Saat itu ada masalah, itu masalah bahasa. Jika dokter dan perawat bisa berbahasa Inggris, pasien tidak bisa.

Bahasa ini adalah bahasa Afrika multibahasa. Sama halnya dengan Indonesia, ada Sunda, ada Jawa, ada Padang, ada Batak, ada juga. Pada akhirnya, saya menggunakan penerjemah.

Kapan minat terhadap tuberkulosis dimulai?

Iya jadi saya berpikir, kalau saya pulang ke Indonesia saya mau ambil dokter spesialis ini, saya mau ambil dokter spesialis tuberkulosis. Bahkan di rumah sakit umum pun kami bertemu dengan pasien tuberkulosis, namun saat itu belum ada ketertarikan.

Namun ketika saya melakukan penelitian di Afrika dan menemukan bahwa TBC mempunyai banyak masalah, bukan hanya sekedar penyakit, saya merasa harus belajar lebih banyak. Jadi setelah penelitian saya kembali ke Jerman, menyelesaikan S2 dan kembali ke Indonesia, kemudian melanjutkan studi menjadi dokter spesialis paru di FKUI.

Sejak Prof dikukuhkan menjadi Guru Besar di FKUI, apakah kesibukannya bertambah?

Pada dasarnya, apakah Anda seorang profesor atau bukan, guru awam atau guru awam, Anda tetap sibuk. Bisa jadi jika Anda menjadi profesor, Anda harus fokus mengajar. Dan mungkin dia akan menambah penelitiannya dengan membimbing lebih banyak dokter dan mahasiswa juga.

Tapi kalau saya sibuk, saya pikir bahkan sebelum saya menjadi profesor, saya sudah sibuk. Selain itu, sebagai guru kita mempunyai Tridharma Perguruan Tinggi, pekerjaan, pendidikan dan penelitian. Oleh karena itu kita harus memenuhi ketiga aspek tersebut.

Kalau dulu Prof bilang dia suka melakukan penelitian, sekarang penelitiannya seperti apa?

Penelitian yang saya lakukan beragam ya, tapi di bidang ilmu pernapasan atau paru-paru. Bermula dari pengobatan TBC, kemudian pada masa Covid, tentang vaksin Covid. Penelitian tentang obat baru.

Lagipula, saya sudah merasakan kebutuhan akan vaksin tuberkulosis sejak lama. Kita mungkin masih ingat atau diberitahu oleh orang tua kita bahwa kita mendapat vaksin TBC, bukan? vaksin BCG. Vaksin BCG merupakan vaksin yang sudah ditemukan sejak lama, yaitu pada tahun 1900an, jadi sudah 100 tahun berlalu.

Namun dalam perjalanannya kami melihat bahwa hal itu tidak berguna. Apa buktinya? Kalau orang divaksin, tidak sakit lagi, tapi TBC masih sering terjadi, bukan? Saat ini terdapat lebih dari 10 juta kasus baru di dunia. Indonesia sekarang juga memiliki lebih dari satu juta kasus, 1.060.000 kasus.

Apa artinya? Vaksin BCG bermanfaat untuk anak ya, dalam mencegah TBC dan salah satu kelebihannya adalah kalaupun anak terkena TBC lalu terkena TBC, penyakitnya tidak serius. Jadi tidak sampai ke otak, tidak sampai ke tulang, tidak sampai ke usus atau lebih.

Kita mengenal TBC meningitis, seperti TBC di otak, TBC di tulang, TBC di usus. Jika Anda mendapatkan vaksin BCG, hal ini tidak akan terjadi. Dan ternyata belakangan kita menyadari bahwa BCG ini tidak bermanfaat bagi orang dewasa.

Saya sempat berpikir, kalau punya mimpi, sudah berakhir, sudah lama, tapi 10 tahun terakhir saya berpikir kenapa tidak ada vaksin TBC baru dan saya sudah ke sana. Saya telah memutuskan untuk mengembangkan vaksin TBC, atau berpartisipasi dalam pengembangan vaksin TBC.

Mengapa hal itu tidak terjadi?

Karena infrastrukturnya tidak kompatibel, biaya penelitian vaksin menjadi sangat tinggi. Kami sepertinya tidak setuju, tidak mungkin. Nah, saat itulah saya menemukan vaksin TBC yang pertama kali dikembangkan oleh perusahaan farmasi bernama GSK. Namun vaksinnya belum siap, masih dalam tahap awal, tahap uji klinis.

Jadi dalam uji klinis ada dua tahap. Tahap praklinis masih pada hewan dan diuji di laboratorium, dan tahap uji klinis pada manusia. Dan ada tahapannya, stadium 1, 2, 3. Sekarang vaksin TBC yang digunakan masih ada di rumah sakit dan belum ada namanya, masih menggunakan kode yang disebut dengan vaksin M72. Nanti kalau kesaktiannya sudah terbukti, mungkin akan ada nama untuknya.

Oleh karena itu penelitian vaksin M72 akan melibatkan delapan negara. Enam negara di Afrika, dua negara di Asia, dan salah satunya Indonesia. Bahkan saya berkesempatan memilih menjadi peneliti utama di tingkat nasional, karena Indonesia akan masuk 5 tempat tapi tentunya harus ada PI nasional, dan saya.

Sekarang kita dalam masa persiapan, izin budayanya sudah ada, kita sedang bersiap. Mudah-mudahan kita akan mulai pada bulan Mei atau Juni, begitu. Semoga kita bisa mengendarainya dengan baik dan mudah-mudahan bagus artinya tenaganya bagus. Jika energinya bagus, maka akan diproduksi dan digunakan di seluruh dunia.

Sejujurnya saya tertarik dengan penelitian ini, karena dari awal saya sangat ingin memiliki vaksin baru dan jika ini berjalan dengan baik, saya akan bangga bahwa Indonesia sebagai negara ikut terlibat dalam pengembangan vaksin ini. Dan kami sebagai dokter Indonesia akan berpartisipasi dalam proyek ini, itu akan sangat menggembirakan.

Apa saja tantangan yang mereka hadapi dalam melaksanakan penelitian?

Oleh karena itu, kita di Indonesia tidak banyak melakukan penelitian klinis, padahal penelitian vaksin termasuk dalam kategori uji klinis. Kami biasanya tidak melakukan uji klinis. Bukan berarti tidak terjadi apa-apa, namun jarang terjadi dan memerlukan infrastruktur yang memadai, terutama laboratorium.

Karena banyak pemeriksaan yang sangat rumit yang harus dilakukan. Terutama tes imunogenisitas yang jarang kita lakukan. Jadi infrastruktur kami tidak membantu. Selain itu, yang lebih sulit adalah biayanya. Uji klinis itu mahal sekali, bukan?

Dari segi jumlah orang, saya rasa kami tidak kalah. Dalam hal pelayanan kemanusiaan, para peneliti, dokter, dan ilmuwan kita sama-sama berbakat. Tapi itulah yang terjadi, laboratorium, laboratorium.

Di seluruh dunia terdapat 16 jenis vaksin yang sedang diteliti di banyak negara. Di Indonesia, kita akan melakukan ini, tapi ada kandidat lain, yaitu vaksin TBC yang tidak divaksin, melainkan dihirup.

Bernapas?

Ya, tarik napas. Jadi teknologinya berbeda. Oleh karena itu, kami juga sedang mempersiapkannya. Dan penarikan vaksin ini, partisipasi saya sangat dalam, mulai dari ikut persiapan prosesnya, mulai dari tahap 1, 2, dan 3. Meski vaksin M72 sudah dibuat negara lain, tapi kita sudah masuk tahap ketiga. Jadi itu sangat keren.

Dan saya juga mohon doanya dari masyarakat agar hal ini bisa terlaksana, walaupun ada kendala lain seperti gagasan vaksin itu dibuat, vaksin itu palsu. Banyak pengguna internet juga terkena dampaknya. Jadi pengalaman saya dengan Covid, ketika saya berbicara tentang vaksin, banyak juga yang berkomentar negatif.

Saya juga ingin berbicara tentang Covid, yang sekarang kita sebut sebagai Covid terkendali. Namun bukan berarti tidak ada kasus. Ada kasus, ada yang dirawat, ada yang punya penyakit penyerta dan belum divaksin. Banyak yang melakukannya.

Tapi netizennya luar biasa, jadi luar biasa. Tapi ya, karena saya punya banyak pengetahuan tentang hal ini dan saya yakin bermanfaat, saya tetap mengajarkan tentang vaksin ini.

Tadi Prof bilang TBC itu ada banyak jenisnya, bisa dijelaskan apa itu TBC?

TBC itu penyakit menular kan? Namun jangan salah, banyak orang yang mengira bahwa TBC adalah penyakit keturunan atau penyakit ini menular melalui sihir, makanan, dan sebagainya. Kami ingin menjelaskan bahwa tuberkulosis adalah penyakit menular yang disebabkan oleh bakteri. Ingat, bakteri, bukan yang lain, bukan turunannya.

Dan bakteri itu ada di udara, tidak terlihat dan karena berada di udara maka bisa keluar dan masuk ke dalam tubuh. Bernafas melalui saluran pernafasan. Namun jangan panik karena penderita TBC di Indonesia masih banyak.

Sekitar 1 juta 60.000 kasus per tahun. Jadi semua orang takut? Tidak perlu panik karena 70 persen orang menghirupnya, namun tidak sakit. Mengapa? Sebab, sistem kekebalan tubuh bisa berjuang mengatasi kuman tersebut.

Saat ini, 30 persen tertular, namun tidak sakit. Tertular berarti kuman TBC ada di dalam tubuh ya. Jadi mereka masuk ke dalam tubuh melalui paru-paru, dan bisa juga masuk ke pembuluh darah dan saraf.

Lalu menyebar ke organ lain, bisa ke tulang, bisa ke otak, hati, usus, jantung, bahkan kulit. Oleh karena itu, 80 persen infeksi paru-paru menyebabkan TBC paru, namun 20 persennya dapat menyerang organ lain.

Oleh karena itu, saya juga ingin menyampaikan bahwa yang tertular adalah TBC paru. Karena menular, kuman keluar melalui batuk dan terpapar ke luar. Tapi kalau TBC kelenjar misalnya di leher, bisa juga ditemukan. TBC kelenjar, TBC tulang, TBC lambung tidak menular karena tidak bisa keluar ya? Yang tertular adalah TBC paru.

Apakah ini berarti jika kita berbicara dengan orang yang menderita TBC paru, bisa membuat kita tertular atau menular?

Ya, TBC paru biasanya menular melalui batuk, kuman keluar, namun paling banyak keluar saat seseorang bersin. Ya, ada banyak kuman. Tapi kalau di paru-paru, di saluran nafas banyak kumannya, tidak perlu batuk, kalaupun bicara bisa menyebabkan keluarnya kuman, bisa menular. Ada banyak mikroba.

Saya sedikit bersyukur dengan Covid, oke? Mengapa? Karena di masa Covid, masyarakat sudah terbiasa memakai masker. Sebelum Covid, sulit bagi saya untuk menyuruh pasien memakai masker. Meski dikatakan jika memakai masker tidak akan menularkan kuman ke orang lain. Sebab saat berbicara, batuk atau bersin, kumannya menempel di masker, bukan di udara.

Yang jelas sejak Covid, masyarakat sudah terbiasa memakai masker. Jadi sekarang pasien pakai masker biasa saja, tidak masalah. Jadi ada hikmahnya bagi Covid, bukan?

Dari pengalaman Prof, apa saja tantangan dalam menangani pasien TBC?

Yang pertama adalah pasien-pasien ini terkadang tidak memahami TBC. Mereka pikir, saya tidak mengidap TBC, kenapa saya bisa mengidap TBC, lalu mereka menolak. Penolakan. Karena menurut saya tidak semua penduduk asli menderita TBC. Jadi mari kita jelaskan kembali bahwa TBC itu penyakit menular, bukan penyakit keturunan, bukan penyakit orang lain.

Terus ada juga yang bilang, iya mau minum obatnya tapi gak mau lama-lama. Nah ini satu lagi permasalahannya, kami jelaskan bahwa produk ini membutuhkan waktu yang lama. Penelitian menunjukkan bahwa saat ini masyarakat membutuhkan waktu 6 bulan untuk melaporkan kesembuhan karena mikrobanya banyak, sifat mikrobanya berbeda-beda, dan dibutuhkan lebih dari satu obat.

Ada empat atau tiga jenis obat, tapi kebanyakan empat, dan bertahan selama enam bulan. Bahkan baru-baru ini menerapkan pengobatan TBC 4 bulan. Oleh karena itu banyak kemajuan yang didapat dari perkembangan ilmu pengetahuan untuk membuat pasien lebih nyaman. Dan tujuannya adalah mewujudkan upaya untuk mengakhiri TBC pada tahun 2030.

Jadi banyak sekali teknologinya, termasuk mendapatkan teknologi penyakit terkini, lalu ada vaksin baru, ada obat baru yang dulunya masa pengobatannya 6 sampai 4 bulan. Sebenarnya yang terbaik di dunia adalah TBC pengobatannya sendiri memakan waktu dua minggu, tapi itu masih lama. Kami sekarang menjalani pengobatan TBC selama empat bulan.

Lalu ada pengobatan TBC resistan obat yang biasanya memakan waktu 18 bulan atau dua tahun, paling singkat 9 bulan. Sekarang sudah 6 bulan dan kita sudah melakukan penelitian dan angkanya sangat tinggi, 97,3. dalam seratus .

Makanya saya dukung di Indonesia pengobatan TBC RO yang dibatasi 6 bulan sudah mulai dilakukan dengan cara yang sama. Saat ini sudah banyak rumah sakit yang mampu melakukan hal tersebut, di banyak daerah. Jadi saya sangat senang ada kemajuan seperti itu.

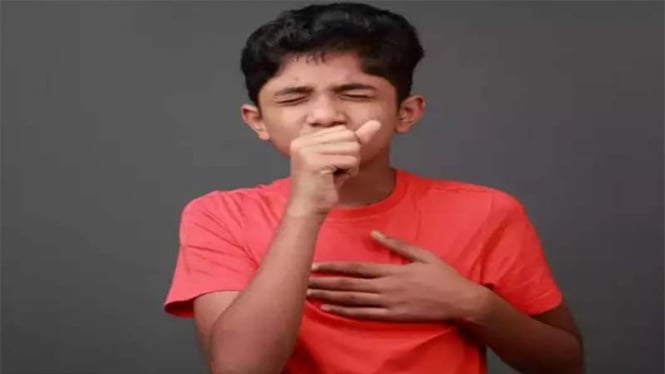

Apa gejala awal orang terdiagnosis TBC, Prof?

Baiklah saya bahas dulu tentang TBC paru, karena sebagian besar adalah TBC paru, saya bilang 80 persen. Jadi untuk TBC paru gejala yang paling umum adalah batuk. Batuk ya. Lalu ada gejala lain yang tidak dirasakan penderita, seperti panas, atau demam namun tidak terlalu tinggi. Jadi begitulah cara Anda menjadi lebih baik, dan kemudian Anda bisa kembali normal tanpa pengobatan. Demam datang dan pergi, demam datang dan pergi.

Ada kalanya saya merasa lelah, capek, capek, namun orang cenderung menganggap saya capek karena pekerjaan, karena pekerjaan saya sangat banyak. Dan nafsu makannya menurun, sehingga jika lama kelamaan nafsu makannya menurun maka berat badannya pun menurun. Tapi kadang yang penentang bilang, ya Dok, saya terjatuh karena mulai makan. Saya melakukan banyak olahraga untuk menurunkan berat badan.

Saat saya jelaskan kepada pasien, berat badannya turun, bukan? Ya Nah, ini salah satu gejala TBC. Tidak dok, saya sebenarnya sedang makan. Padahal ini salah satu tandanya ya. Selain itu, jika paru-paru membesar, penyakit ini bisa menyebabkan sesak napas. Tapi kalau serius. Kalau tidak masalah, Anda hanya batuk saja.

Dan jika menyerang bagian luar paru-paru, yang dalam istilah medis kita sebut pleura, seringkali timbul nyeri dada. Tapi kalau hanya di paru-paru, tidak ada rasa sakit di dada. Ya, terutama batuknya, lalu demamnya. Itu batuk biasa, tidak ada yang namanya batuk biasa. Orang normal tidak batuk.

Bolehkah batuk dan pilek?

Ya, jadi ada angin, kan? Ya, orang normal tidak batuk. Kalau batuk pasti ada sesuatu. Batuk merupakan refleks saluran napas untuk mengeluarkan udara. Misalnya karena ada dahak, karena peradangan misalnya ada dahak.

Dahak tidak dapat berlama-lama di saluran nafas, sehingga saluran nafas akan melakukan refleks batuk dan dikeluarkan. Kalau kamu TBC, kamu juga punya jerawat, kamu batuk karena ingin menghilangkannya.

Artinya kalau misalnya batuk dan bersin, berarti ada yang tidak beres?

Ada sesuatu, dan salah satunya di Indonesia, terutama karena kita adalah negara kedua di dunia dengan TBC tinggi. Nomor 2 di dunia, jadi di Indonesia kalau orang batuk, terpikir mungkin itu batuk rejan. Dan saya ingatkan, TBC bisa diobati, bisa dicegah.

Jadi tidak ada alasan untuk malu dan tidak ada alasan untuk takut. Hanya memeriksanya untuk pembaruan cepat. Kalau itu Covid, kita tidak boleh malu. Hei, aku demam. Bisa jadi saya kena Covid, harus di swab ya? Hal yang sama juga harus dilakukan untuk tuberkulosis.

Mengapa ada pandangan seperti itu tentang TBC?

Jadi karena stigmanya. Diskriminasi. Masih banyak orang yang menghindari TBC di masyarakat. Anak-anak tidak diajak bermain, mereka didiskriminasi. Jika berhasil, Anda bisa dipecat. Hal inilah yang menyebabkan masyarakat takut tertular TBC.

Ada perusahaan yang bagus, mereka menyuruh mereka istirahat, mereka menyuruh mereka untuk berhati-hati. Setelah itu, bila tidak mengidap TBC, bekerja lagi. Ada sesuatu seperti itu. Teman yang baik, ya? Namun ada pula yang kikuk dan akhirnya kontraknya tidak diperpanjang dalam waktu lama.

Namun TBC bisa disembuhkan. Jika Anda sembuh, jika tidak, jika Anda sudah menjalani pengobatan selama satu atau dua bulan dan tidak sembuh, itu tidak menular. Jadi jangan takut.

Artinya dalam pencegahannya bisa juga dengan mengonsumsi multivitamin untuk memperkuat daya tahan tubuh ya, Prof?

Benar sekali, karena hubungannya terutama adalah daya tahan atau imunitas tubuh. Karena kuman TBC ada di udara, kita tidak bisa melihatnya kan? Kemungkinan kita semua bisa muntah saat bepergian, bukan? Di sini kita tidak bisa memilih siapa yang tidak mengidap TBC, kita tidak bisa, kita tidak bisa menemui mereka.

Pengalaman TBC, ada satu keluarga yang terdiagnosis TBC paru, batuk-batuk, lalu dilanjutkan pemeriksaan. Gejalanya sama seperti yang dikatakan profesor, ya demam terus datang. Paru-parunya terserap seperti cairan berwarna merah muda. Namun tidak lama kemudian, punggungnya sakit. Mengapa ya, Prof?

Tadi sudah saya jelaskan bahwa kuman TBC bisa merusak seluruh bagian tubuh. Jadi, bisa sampai ke otak, ke tulang, ke paru-paru. Makanya ada air, makanya mereka menyusui. Ya, itu sebenarnya keluar dari paru-paru. Tapi kenapa dia batuk? Karena letaknya di garis paru-paru, ia memberi tekanan pada paru-paru, paru-paru terdorong sehingga batuk adalah salah satu cara untuk mengimbanginya.

Baiklah, tapi saya juga ingin menjelaskan kepada masyarakat dimanapun mereka menderita TBC, apapun organ yang tertular atau terkena, obatnya sama, OAT atau obat anti TBC. Perbedaannya hanya pada durasi pengobatan. Untuk TBC paru biasanya membutuhkan waktu 6 bulan, sedangkan TBC paru biasanya membutuhkan waktu lebih lama. Bisa 9 bulan, bisa setahun, bisa 1,5 tahun, bahkan 2 tahun, tergantung berat ringannya penyakit.

Dan itu berdampak pada tulang belakang sehingga keropos, Prof?

Ya, itu sangat menyakitkan. Jika pasien saya sakit, saya kasihan pada mereka. Berjalan sambil berdiri adalah apa adanya. Mengenakan korset juga menyakitkan. Ada beberapa pasien yang memerlukan pembedahan, untuk membersihkan tulangnya.

Lalu ada spidol yang disisipkan juga. Tapi walaupun sudah dioperasi, obatnya tetap harus diminum. Tak terasa operasinya sudah sembuh, tidak. Anda masih membutuhkan obatnya.

Agak menakutkan ya Prof?

Tidak masalah, TBC bisa disembuhkan dan dicegah. Jadi pesan saya, kalau ada gejala segera periksakan diri. Bahkan jika Anda terdiagnosis TBC, tidak perlu khawatir. Obat-obatan tersedia, obat-obatan efektif, dan gratis jika Anda pergi ke rumah sakit umum.

Dan tidak hanya minum obat dua minggu, dua bulan, gejalanya langsung hilang dan berhenti, itu tidak boleh. Sebaiknya obat ini diminum sampai habis. Jadi kalau sudah dua bulan atau dua minggu, kumannya belum mati semua. Ada yang mungkin mati, ada pula yang tetap lemah, namun harus sampai semua kumannya mati.

Dan itu memerlukan waktu, untuk paru-paru 6 bulan. Jangan berhenti sebelum 6 bulan atau sebelum dokter Anda memutuskan untuk berhenti, karena Anda mungkin tahu lagu Apa yang Tidak Membunuh Anda Akan Membuat Anda Lebih Kuat? Oleh karena itu, jika obat tidak digunakan, mikroba tidak akan mati. Itu tidak membunuh. Maka mikroba tersebut akan menjadi lebih kuat dengan cara mengubah, menjadi mikroba yang lebih kuat dan tahan yang telah terbukti efektif.

Inilah sebabnya mengapa kita membutuhkan obat-obatan yang lebih kuat, efektif dan tahan lama. Oleh karena itu, jangan membuang obatnya, karena jika obat dihentikan maka ada kemungkinan terjadi resistensi terhadap obat atau resistensi terhadap obat. Kalau berhenti ya mudah, tapi kalau berhenti narkoba susah.

Kalau dilihat-lihat Prof aktif banget di media sosial ya, tapi kebanyakan di Twitter atau X. Kenapa suka platform ini Prof?

Saya aktif setelah Covid, dari pandemi ke pandemi. Selama epidemi saya sangat sibuk. Jadi begitu berat badan saya mulai turun, saya mulai bekerja keras lagi. Saya punya IG, saya punya TikTok, tapi saya tidak menari, saya sangat terpelajar dan saya punya Twitter.

Awalnya Twitter sepi, tapi setelah saya kerja setiap hari, menulis kajian, saya lihat Twitter banyak aktivitasnya, banyak komentarnya. Kalaupun bicara vaksin, ada ulasan negatifnya, tapi ini bagus. Keuntungannya juga banyak.

Dan saya melihat Twitter punya banyak akses, itu sangat umum. Kebanyakan IG saya seperti dokter atau teman. Tapi di Twitter itu sangat, sangat acak. Siapa pun bisa melakukan itu, bukan? Dan saya senang jika pelajaran yang saya berikan dapat ditemukan oleh banyak orang.

Dengan jadwal yang padat saat ini, apakah Anda masih punya waktu untuk saya atau bertemu keluarga, berbuka puasa bersama keluarga, misalnya?

Saya selalu berusaha untuk melewatkan waktu makan, karena selain bekerja di rumah sakit pemerintah, saya juga bekerja di siang hari. Tapi saya selalu kesana, sejak saya lulus, sejak saya menjadi ahli, saya belum mencobanya. 4 sampai 6:00 Saya tidak melakukan apa pun sampai jam 10:00 malam, tidak. Begitulah yang selalu terjadi.

Biar gak bosen sampai malam ya, ada kelelahan mental. Bagus juga karena saya punya anak banyak juga, saya punya empat anak. Jadi sejak kecil, saya berusaha mencari waktu untuk mencuci dan memakainya.

Meski aku tidak bisa mengantarnya setiap hari, aku berusaha mengantarnya ke sekolah sesekali, begitu saja. Karena aku bekerja di rumah sakit, aku tidak bisa menerimamu seperti itu. Jadi saya berusaha memastikan bahwa kami masih punya waktu untuk dihabiskan bersama keluarga. Artinya, ini mengurangi waktu ujian.

Bagaimana dengan waktumu, Prof?

Di sana, waktunya tidak disengaja, bukan? Jika anak saya mendengarkan lagi saya dianiaya. Waktu itu saya sering menghadiri kongres, saya sering diundang menjadi pembicara atau rapat, banyak pembicara di luar. Juga, jika saya keluar, saya tidak bekerja, saya tidak bekerja.

Selain itu, setelah rapat, setelah berbicara di rapat, saya biasanya jarang keluar. Kadang-kadang saja. Jadi sebagian besar waktuku tinggal di hotel, aku menghabiskan waktuku di telepon, kadang-kadang aku menelepon anak-anakku, aku menelepon teman-temanku, tapi aku menghabiskan waktuku di kamar hotel.

Tapi tidak sering kan? Anda pergi ke kongres dari waktu ke waktu, bukan? Tapi aku merasa inilah waktuku. Jika Anda tidak punya waktu di rumah, Anda punya 4 anak. Kalau pertemuannya di Jakarta, harus latihan siang hari. Usai pertemuan, saya menjadi pembicara selama satu jam, kembali bekerja. Kembali ke rumah sakit. Tidak ada waktu untukku. Teruslah berbicara dengan orang lain. Saya biasanya tidak punya waktu, waktu saya sangat mahal.

Sebagai peneliti dan dokter, bagaimana Prof melihat peran perempuan di dunia tempat mereka bekerja saat ini, apakah ada diskriminasi?

Saya tidak melihat ada diskriminasi terhadap perempuan, mungkin ada sedikit di beberapa pekerjaan. Misalnya pekerjaan ini baik untuk laki-laki, pekerjaan ini baik untuk perempuan. Tapi aku merasa sedikit. Tapi mungkin karena profesi saya dokter, sepertinya tidak ada diskriminasi.

Namun saya menyadari bahwa dalam situasi tertentu, dalam pekerjaan tertentu, diskriminasi terhadap perempuan masih bisa terjadi, namun tidak terlalu kuat. Tapi saya lihat itu tidak terjadi di Indonesia, bukan masalah besar ya?

Karena buktinya semakin banyak perempuan yang menjadi dokter, bukan? Banyak perempuan bekerja di kantor, banyak perempuan bekerja di bank, banyak perempuan mengemudi. Ya, negara-negara melaporkan bahwa perempuan diizinkan mengemudi. Di Indonesia dingin banget, di negara kita cewek muslim kan?

Jadi menurut saya mungkin ada sedikit diskriminasi, tapi mungkin tidak terlalu banyak. Jadi, aku tahu makanya, aku dari Padang ya? Padangs dan matriarkal, artinya perempuan mengambil bidang yang diperlukan. Meski tak terdengar lagi di sini, Matriarnya masih sama kan?

Jadi, di manakah hal terbaik bagi wanita?

Ketika saya membaca dan pergi ke daerah lain, jumlahnya menjadi banyak. Oleh karena itu, kalau bisa saya persiapkan secara bertahap kata ini adalah diskriminasi kecil di Indonesia yang kecil, tapi mungkin banyak orang Indonesia yang tertekan, khususnya di bidang pendidikan.

Kalau kita lihat di desa-desa, banyak sekali anak perempuan yang tidak bersekolah, mungkin tamatan SD, jangan disimpulkan dengan perkembangan keilmuan dan karya yang baik, dan lihatlah.

Jadi saya tetap mendorong perempuan untuk mengasuh anak-anaknya agar bisa bersekolah semaksimal mungkin, karena mereka harus diberi hak untuk bekerja dengan baik.

Kalau kita bicara tentang kota-kota besar, kelihatannya tidak bagus. Namun di kota-kota kecil atau desa-desa, kami masih merasa bahwa anak perempuan belum mendapatkan hak untuk bersekolah sebagaimana mestinya.

Namun terutama karena masalah ekonomi. Jadi masalah keuangan memaksa anak perempuan untuk beristirahat dibandingkan anak laki-laki. Kadang-kadang anak laki-laki dijadikan yang pertama, karena orang tuanya mempunyai uang yang lebih sedikit.

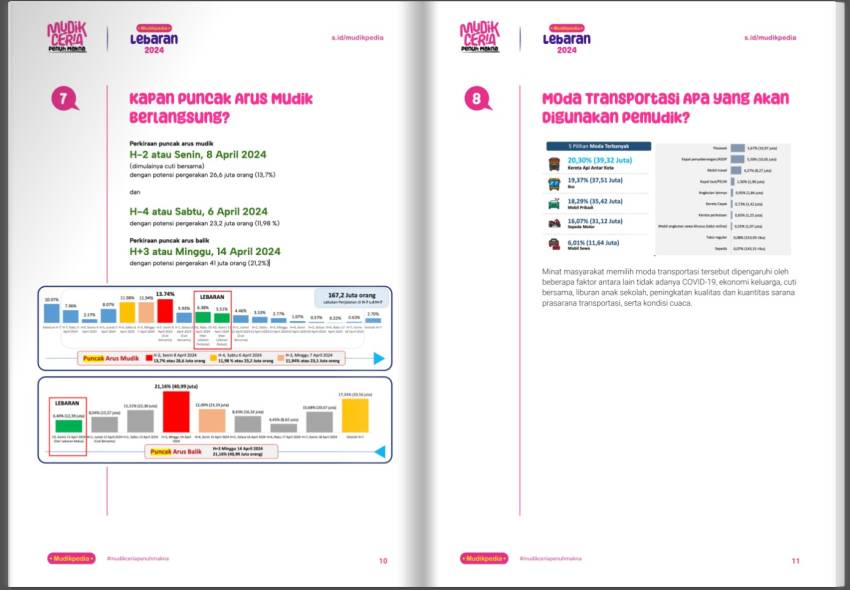

Oke Prof, sebentar lagi lebaran, apakah bapak kembali ke Padang?

Dulu aku sering pulang ke rumah karena orang tuaku masih ada, ibuku masih ada. Sentuh masakan ibuku. Saya ingin berbicara dengan anggota keluarga kami. Namun dengan padatnya jadwal dan kemacetan jalanan di Padang, sepertinya tidak ada kata kembali ke rumah.

Coba kita lihat misalnya padang di Bukku Tepugi yang biasanya memakan waktu satu jam, dua jam, bisa 5 jam, 7 jam karena semua orang pulang dan naik mobil. Wow, itu pample yang luar biasa. Jadi sekarang aku akan berkeliling, aku akan pulang. Mungkin dua minggu kemudian, orang-orang akan kembali,

Tapi pulanglah secara teratur, kata-kata?

Tidak selalu setiap tahun, karena itu pekerjaan saya, kadang saya bisa pulang padang untuk bekerja. Misalnya ada Msamin, ada rapat, tapi suatu hari nanti. Ada yang jalan kaki, ada yang menginap minimal satu malam. Kalau hotelnya sudah diajukan, biasanya saya tolak, saya di rumah saja.