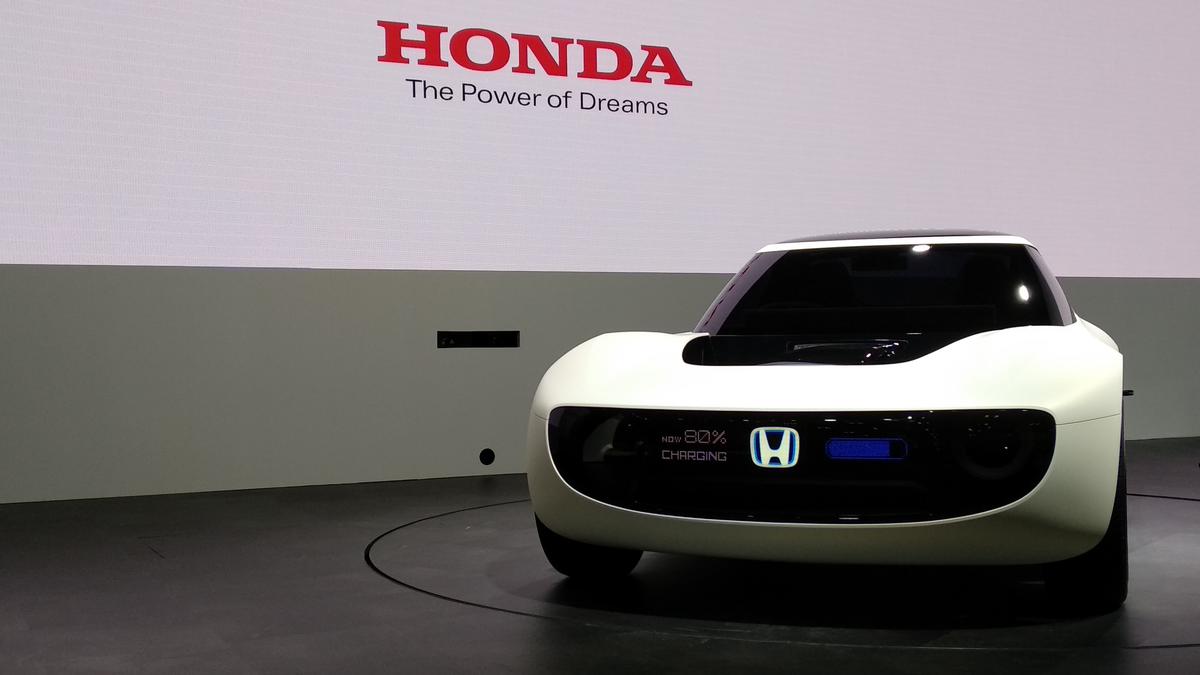

bachkim24h.com, JAKARTA — Harga mobil listrik turun drastis hingga kini hampir sama terjangkaunya dengan mobil biasa. Sejak mobil listrik pertama kali hadir di pasaran, pembeli mobil harus membayar sejumlah biaya jika menginginkan mobil yang menggunakan baterai.

Namun kondisi saat ini berbeda. Dua tahun lalu, rata-rata konsumen akan membayar sekitar $17.000 lebih mahal untuk sebuah mobil listrik baru dibandingkan mobil baru bertenaga gas. Namun kesenjangan tersebut ditutup dengan cepat, turun menjadi $5.000 pada bulan lalu.

The Washington Post melaporkan pada Selasa (19/3/2024) bahwa ini merupakan kenaikan 11 persen dibandingkan harga rata-rata mobil baru bulan lalu, dan selisih harga yang hampir sama antara memilih model dasar mobil lain dibandingkan mobil. . . Model kerja dilengkapi dengan segala fasilitas.

Alasan lain turunnya harga kendaraan listrik adalah konsumen tidak membelinya secepat yang diharapkan para pemasar dan produsen mobil. Ketika industri ini beralih dari sekedar pengguna awal yang antusias, kini mereka menghadapi pembeli mobil yang khawatir akan infrastruktur yang mahal dan biaya awal yang tinggi.

Harga rata-rata sebuah EV turun $2.000 bulan lalu. “Kami akan terus melihat penurunan harga atau diskon karena ada persediaan dan (dealer) ingin menjualnya,” kata Stephanie Valdez Streaty, direktur Industry Insights di Cox Automotive.

Ini adalah kabar baik bagi orang Amerika yang mencari mobil baru yang mungkin mempertimbangkan untuk menggunakan mobil listrik. “Biaya selalu menjadi salah satu hambatan utama dalam implementasi, jadi menurut saya penting untuk mencapai keseimbangan biaya,” katanya.

Tesla, yang menjual lebih banyak mobil listrik di Amerika Serikat dibandingkan gabungan semua produsen mobil lainnya, adalah pendorong di balik penurunan harga kendaraan listrik. Produsen mobil tersebut mulai memotong harga SUV Model Y dan sedan Model 3 yang populer pada Januari 2023, sehingga menurunkan harga rata-rata untuk semua mobil listrik.

Misalnya saja sedan dasar Model 3 yang di awal tahun 2023 dibanderol US$ 47.000, kini dijual seharga US$ 39.000. Model premium Y turun dari 70 ribu dollar AS menjadi 52 ribu dollar AS pada periode yang sama.

“Tesla mungkin menurunkan harga untuk mempertahankan pangsa pasarnya ketika produsen mobil mulai menjual mobil listrik,” kata Valdez Streaty.

Saat ini terdapat 57 model EV yang dijual di AS. Meskipun Tesla pernah menguasai sekitar 80 persen pasar AS, kini Tesla hanya menguasai sebagian besar pasar (dan banyak pesaing utamanya memangkas harga). “Tesla masih lebih besar, tapi persaingannya sekarang sangat besar,” kata Valdez Streaty.

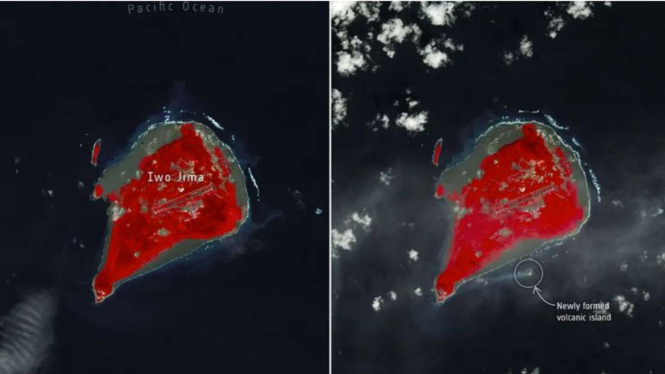

Penurunan harga kendaraan listrik pada bulan lalu merupakan bagian dari tren jangka panjang menuju mobil listrik yang lebih murah, terutama karena harga baterai yang lebih rendah. Harga baterai saat ini hampir 90 persen lebih rendah dibandingkan tahun 2008.

“Baterai dapat menyumbang 40 persen biaya kendaraan. “Kita akan melihat harga baterai terus turun, jadi saya pikir kita akan mulai melihat penutupan ini mendekati harga tersebut,” kata Valdez Sttreaty.

Menurut laporan tanggal 7 Maret 2024 dari perusahaan konsultan teknologi Gartner, biaya pembuatan mobil listrik baru bisa turun ke tingkat yang sama dengan mobil bertenaga gas pada tahun 2027 karena produksi yang efisien.

Menurut jajak pendapat Washington Post-University of Maryland pada tahun 2023, biaya kendaraan listrik adalah kendala terbesar bagi lansia Amerika. Jika harga terus turun seperti yang terjadi bulan lalu, mungkin akan lebih banyak orang Amerika yang bersedia meninggalkan mobil mereka yang boros bahan bakar dan beralih ke mobil listrik.

bachkim24h.com, JAKARTA — Pengurus Besar Persatuan Dokter Indonesia (PB IDI) mengingatkan masyarakat perlunya menjaga kesehatan. Caranya adalah dengan mempersiapkan dan melakukan tindakan pencegahan sebelum melakukan perjalanan berlibur, bisnis, atau bekerja di masa perubahan ini.

“Kewaspadaan dalam situasi darurat merupakan hal penting yang harus selalu dilakukan masyarakat. “Perubahan cuaca ekstrim dari panas ke hujan atau sebaliknya dapat berdampak pada kesehatan kelompok rentan seperti anak-anak, lansia, ibu hamil, atau penyandang disabilitas,” kata Ketua Umum Pengurus Besar Persatuan Dokter Indonesia (PB IDI) itu. Dr. Adib Humaydi, SpOT dalam keterangan pers yang diterima, Jumat (4/12/2024).

Sebab, bulan April, selain masa libur panjang akibat perayaan Idul Fitri, juga berada di tengah musim perubahan yang bertepatan dengan perubahan iklim drastis yang dapat menimbulkan risiko kesehatan. PB IDI juga merekomendasikan beberapa tindakan pencegahan kesehatan selama musim liburan saat ini, termasuk mendapatkan vaksinasi flu setidaknya satu hingga dua minggu sebelum bepergian jika Anda dalam keadaan sehat dan tidak mengalami gejala flu apa pun.

Vaksinasi membantu melindungi diri sendiri dan mengurangi kemungkinan penularan virus ke orang lain. Selain pencegahan influenza, Ketua Satgas Covid-19 PB IDI, Guru Besar, Dokter, dr Erlina Burhan, SpP(K) juga merekomendasikan pelaksanaan vaksinasi dini Covid-19 dan vaksinasi ulang.

Penelitian menunjukkan bahwa orang yang telah divaksinasi Covid-19 memiliki peluang lebih kecil untuk menularkan Covid-19 kepada orang lain, sehingga lebih aman bagi dirinya dan orang lain saat bepergian. Orang lanjut usia dan orang dengan kondisi kesehatan lain bisa tertular Covid-19 secara gratis melalui puskesmas dan puskesmas.

Sementara itu, masyarakat umum di luar sistem pelayanan kesehatan yang diamanatkan pemerintah bisa mendapatkan vaksinasi Covid-19 swasta (berbayar) melalui klinik dan rumah sakit yang menyediakannya. Meski kasus Covid-19 mengalami penurunan dibandingkan masa epidemi, namun penyakit ini tetap ada dan penting bagi tubuh untuk terus melindungi diri dari penyakit ini dengan bantuan suntikan, kata Erlina.

Ia juga mengingatkan masyarakat untuk mengecek tujuan perjalanan ini untuk mengetahui kegiatan apa saja yang akan dilakukan dan juga untuk memeriksakan kesehatannya. PB IDI merekomendasikan strategi asuransi, baik swasta maupun BPJS Kesehatan.

Jika tubuh Anda belum sempurna, jangan memaksakan diri untuk berjalan. Pertimbangkan untuk menunda rencana Anda selama 24 jam setelah demam dan gejala lainnya mereda tanpa menggunakan antipiretik.

PB IDI juga menyarankan untuk mengecek peraturan kesehatan setempat dan peraturan wabah Covid-19, flu atau penyakit lainnya di wilayah yang Anda tuju, termasuk peraturan di luar negeri. Pasalnya, setiap negara memiliki undang-undang dan peraturan berbeda mengenai perjalanan dan Covid-19.

Sebagai tindakan pencegahan, siapkan perbekalan kesehatan untuk perjalanan, seperti obat-obatan sehari-hari yang harus diminum, serta obat-obatan darurat seperti obat luka, pereda demam dan nyeri, obat flu, dan pembersih luka. Jaga juga kebersihan tangan dengan menggunakan hand sanitizer, sabun, atau tisu basah, terutama setelah digunakan.

Cuci tangan pakai sabun dan air mengalir selama kurang lebih 20 detik atau gunakan hand sanitizer (hand sanitizer atau tisu basah) yang mengandung alkohol 60 persen. Jika tangan kotor, jangan menyentuh mata, hidung, atau mulut, menutup mulut dan hidung dengan tisu saat batuk atau bersin, lalu membuang tisu bekas tersebut. Berhati-hatilah saat berada di keramaian, kenakan masker, terutama jika Anda sedang tidak bugar atau baru saja sakit.

Masker tidak hanya melindungi dari penularan penyakit, tetapi juga dari debu dan polusi yang dapat menimbulkan penyakit. Selain itu, kenakan masker saat berada di pesawat atau angkutan umum dan jaga jarak agar tidak sakit atau berisiko dicopet.

PB IDI juga mengingatkan pentingnya menjaga dehidrasi dan tidur yang cukup agar fokus bergerak, terutama saat bepergian. Minumlah delapan gelas air sehari agar tetap terhidrasi dan tidur enam hingga delapan jam sehari.

Hidrasi dan istirahat yang cukup penting untuk sistem kekebalan tubuh yang sehat. Terakhir, dengarkan berita atau pengumuman pemerintah tentang apa yang terjadi dengan situasi penyakit, terutama di daerah terkendali, seperti flu, demam berdarah, dll, dan selalu periksa kesehatan Anda dari waktu ke waktu.

Terutama bagi mereka yang menderita penyakit diabetes, hipertensi dan penyakit lainnya yang memerlukan perhatian khusus. PB IDI berharap perjalanan masyarakat dari dan ke suatu tempat dapat lancar dan terhindar dari kejadian yang tidak diinginkan.

bachkim24h.com, JAKARTA – Manajer Manchester United (MU) Erik ten Hag mengaku timnya siap menghadapi tuan rumah Bournemouth pada lanjutan Liga Inggris di Vitality Stadium, Sabtu (13/4/2024) pukul 23.30 WIB. Meski demikian, pelatih asal Belanda itu tidak ingin MU mengulangi kesalahan yang sama seperti pertemuan pertama kedua tim musim ini.

“Kami tidak siap secara mental untuk pertandingan itu. Bournemouth melawan dan kami kalah dalam pertarungan,” kata Ten Hag mengenang pertandingan pertama melawan The Cherries yang dimenangkan Setan Merah 0-3 di Old Trafford Desember lalu.

Ten Hag menegaskan Bournemouth tidak akan berubah karena itulah permainan mereka. Mengandalkan kecepatan dan pertahanan solid, Bournemouth selalu siap menantang tim mana pun.

Karena itu, Ten Hag memastikan pemainnya sudah siap saat menghadapi laga melawan Bournemouth. Para pemain MU membutuhkan perjuangan itu dengan tekad yang harus saling mendukung.

“Kami harus memenangkan pertarungan dan berusaha mengalahkan mereka agar bisa berlari lebih cepat dari mereka dan pertahanan,” ujarnya seperti dilansir Antara dari laman resmi grup. “Kami harus menyamai kecepatannya.”

Manchester United berada di urutan keenam dalam tabel Liga Premier Inggris dengan 49 poin dari 31 pertandingan. Tim besutan Erik Ten Hag mencatatkan 15 kemenangan, empat kali imbang, dan 12 kali kalah.

Gol MU juga terlihat kebobolan sebanyak 46 kali. Saat ini, juara kota Manchester City mampu mencetak 45 gol.

Dengan tujuh pertandingan tersisa musim ini, Manchester United harus terus meraih kemenangan untuk menjaga peluang finis di empat besar. Man United saat ini tertinggal 11 poin dari peringkat keempat Tottenham Hotspur.

bachkim24h.com, Jakarta. Pada Minggu, 24 Maret 2024, agensi pemenang MEDAL EMAS Kim Soo Hyun mengumumkan bahwa rumor kencannya dengan penyanyi Kim Se Ron tidak benar. Terkait foto yang diunggah Kim Sae Ron di akun Instagram Stories pribadinya @ron_sae lalu dihapus tiga menit kemudian, mereka mengatakan bahwa foto tersebut diambil saat mereka masih berada di restoran yang sama di masa lalu.

Peraih MEDALI EMAS itu juga mengaku tidak tahu apa yang terjadi pada Kim Se Ron. Selain itu, agensi Kim Soo Hyun juga akan mengambil tindakan untuk melawan fitnah terhadap Queen of Tears.

Meski segera dihapus, foto yang diunggah tadi pagi menjadi viral di media sosial sehingga memicu rumor hubungan pasangan tersebut. Menanggapi rumor tersebut, pihak Kim Soo Hyun membantah sepenuhnya.

Berikut pernyataan agensi Kim Soo Hyun seperti dilansir Soompi.

“Halo, kami dari Medali Emas.

Kami ingin membuat pengumuman mengenai distribusi foto Kim Soo Hyun hari ini.

Kami ingin mengklarifikasi bahwa rumor yang beredar saat ini tentang Kim Soo Hyun tidak berdasar. Foto-foto yang beredar online diambil lama sekali saat mereka berada di tempat yang sama, dan kami tidak memahami tujuan tindakan Kim Se-ron.

Kami menghadapi situasi di mana pemain kami dituduh secara tidak adil dan pencemaran nama baik tersebar luas. Melalui firma hukum kami, kami akan dengan tegas menanggapi klaim pencemaran nama baik dan postingan yang memfitnah.

Kami meminta Anda untuk menghindari rumor dan gagasan yang tidak berdasar. “

Pada 18 Mei 2022, Kim Sae Ron diadili atas tuduhan mengemudi dalam keadaan mabuk dan kecelakaan di berbagai jalan sekitar Gangnam, Seoul.

Dia dinyatakan bersalah dan didenda 20 juta won. Pada saat kecelakaan terjadi, Kim Sa Ron menolak tes alkohol polisi dan meminta tes darah. Tes darah di rumah sakit menunjukkan alkohol 0,2% yang merupakan batas pencabutan izin.

Seperti dilansir situs Sport Donga, kecelakaan tersebut menyebabkan kawasan Sinchon mati listrik selama sekitar empat jam, menyebabkan kerusakan parah dan menuai kritik tajam.

Dia dilaporkan mengunjungi toko korban setelah kecelakaan itu untuk meminta maaf dan menawarkan kompensasi. Kim Sae Ron meninggalkan proyek yang dia ikuti dan mengakhiri kontraknya dengan agensinya tanpa perpanjangan.

bachkim24h.com, Jakarta Banyak manfaat doa yang diajarkan para nabi zaman dahulu, termasuk doa Nabi Daud. Pembacaan doa Nabi Daud dikatakan dapat menenangkan hati yang keras kepala.

Ketika kita membaca doa Nabi Daud, kita bisa memohon kepada Allah SWT agar melunakkan atau meluluhkan hati orang yang kita idamkan. Doa yang dipanjatkan Nabi Daud untuk kita ini bisa memudahkan kita ketika ingin membuat seseorang luluh dengan permintaan kita.

Misalnya ketika seseorang melakukan maksiat. Karena hatinya begitu keras, tidak ada nasihat yang mampu mengembalikannya. Kita bisa membaca doa Nabi Daud yang berdoa kepada Allah SWT agar melunakkan atau meluluhkan hatinya agar meminta nasehat yang baik.

Dengan cara ini dia bisa melihat bahwa kebiasaan buruknya bisa berangsur-angsur membaik. Lalu bagaimana cara membaca doa nabi Daud? Penjelasan lengkapnya berikut ini dirangkum bachkim24h.com dari berbagai sumber, Senin (27/3/2023).

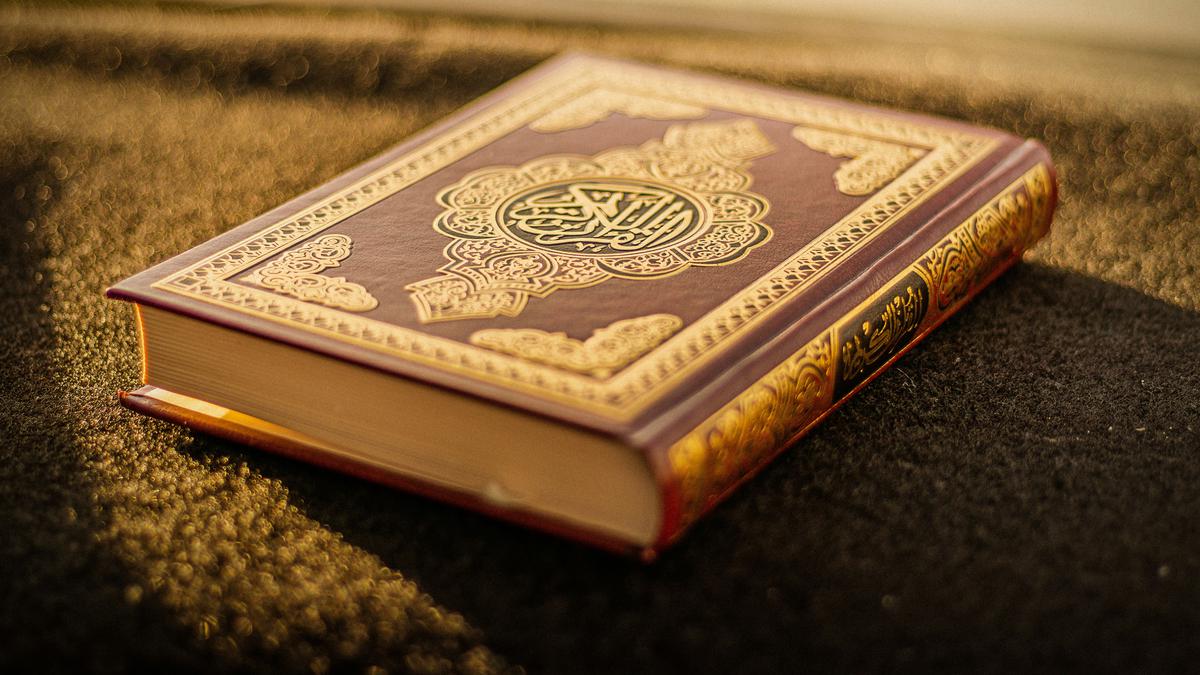

Doa Nabi Daud merupakan doa yang dipanjatkan oleh Nabi Daud SAW ketika sedang melakukan mukjizat dengan melunakkan besi, sebagaimana dijelaskan dalam Al-Qur’an surat As-Saba ayat 10.

Pergilah ke dunia, kami baik hati, tidak akan mengejutkan kami dengan gila.

Artinya : Sesungguhnya kami telah memberikan kepada Nabi Daud suatu pemberian dari kami. (Kami berkata) Gunung-gunung dan burung-burung memuliakan Daud, dan Kami melunakkan besinya.

Berikut beberapa doa Nabi Daud yang bisa kita panjatkan untuk meluluhkan hati: Perlindungan Lingkungan dan Perlindungan Lingkungan

Allahumma innaka antal azizul kabir. Va Anana Abduka Adho I Fudzalil. Alladzii laa haula wa kawwwa sampai bika. Allahumma sakkhir lii (nama orang yang bersangkutan) kama sakkhorta firauna li musa. Ruangan tersebut tidak tercakup dalam perawatan Anda. Fa innahu la yantiqu illa bi idznika. Ini semua tentang negara. Ruangan penuh. Chal Lananova Vajhik. Ya, Arkhamar Rakhimin.

Artinya : Ya Allah, Engkaulah Yang Maha Tinggi dan Maha Mulia, akulah hamba-Mu yang rendah hati, tidak ada kesulitan dan kekuatan selain Engkau Dan kau meluluhkan hatiku seperti kau meluluhkan besi, kau meluluhkan Dawood a.s. 3 Pujian dari wajah Anda sungguh luar biasa, Yang Mulia.

Jika orang yang keras kepala, nasihat yang baik sekalipun, tidak bisa mengubah kebiasaan buruknya, maka kita bisa membaca kitab Nabi Daud untuk memohon kepada Allah SWT agar melunakkan hatinya.

Selain sholawat nabi Daud yang telah disebutkan di atas, kita juga dapat membaca sholawat nabi Daud lainnya dalam format yang lebih singkat agar lebih mudah diingat dan diterapkan semaksimal mungkin. Bacaan singkat doa Nabi Daud adalah sebagai berikut:

Allahumma layinli kalbahu, layyinta li Daudal hadid

Artinya, “Ya Allah, lembutkanlah hati-Mu, sebagaimana Engkau melunakkan kehendak Daud.”

Selain bacaan untuk meluluhkan hati orang yang sulit menerima nasehat yang baik, kita juga bisa membaca doa nabi Daud untuk Menghadapi siapapun yang sulit menerima nasehat atau kritik ra’I. Misalnya kita bisa membaca doa nabi Daud sebelum bertemu dengan seorang pemimpin atau ketika kita ingin menunjukkan sesuatu yang memerlukan persetujuannya.

Kita juga bisa membacakan doa Nabi Daud sebelum meminta persetujuan orang tua kita terhadap keputusan hidup yang telah kita ambil dan putuskan. Ketika sholawat nabi Daud dibacakan, Insya Allah orang yang hatinya meminta luluhnya Allah SWT akan siap mendengar pilihan kita.

Selain membaca doa Nabi Daud agar Allah SWT mengabulkan apa yang kita minta, kita bisa menambahkan pada doa kita beberapa amalan yang diajarkan Nabi Daud.

Diketahui bahwa selain berdoa, Nabi Daud juga menyembah banyak dewa lainnya. Salah satu ritual yang dilakukan Nabi Dawood adalah puasa Shaum Ad-Dahr, yang diambil dari nama puasa Nabi Dawood.

Amalan puasa yang dilakukan Nabi Daud berbeda dengan puasa, puasa satu hari dan tidak puasa satu hari. Puasa ini untuk menunjukkan rasa syukur atas nikmat Allah SWT.

Selain shalat dan puasa, Nabi Daud juga selalu berdoa dan memohon kasih sayang Allah hingga akhir hayatnya. Nabi Daud meminta kasih kepada Tuhan. Doa Nabi Daud juga dipercaya dapat mendekatkan kita dengan jodoh. Doa Nabi Dawud agar lebih dekat dengan permainan tersebut adalah sebagai berikut: Allah

Allahumma inni as-aluka hubbaka wa Hubba man yuhibbuka, wa ‘amalladzii yuballighunii hubbaka. Allahummaj’al hubbaka ahba ilaya min nafsi wa ahlii wa minal ma’il barad

Artinya : Ya Tuhan, aku mohon cintaMu, aku mohon cintaMu, dan aku mohon amalan yang dapat membawaku kepada cintaMu. Ya Tuhan, jadikan aku mencintaimu lebih dari diriku sendiri, keluarga dan air dingin.

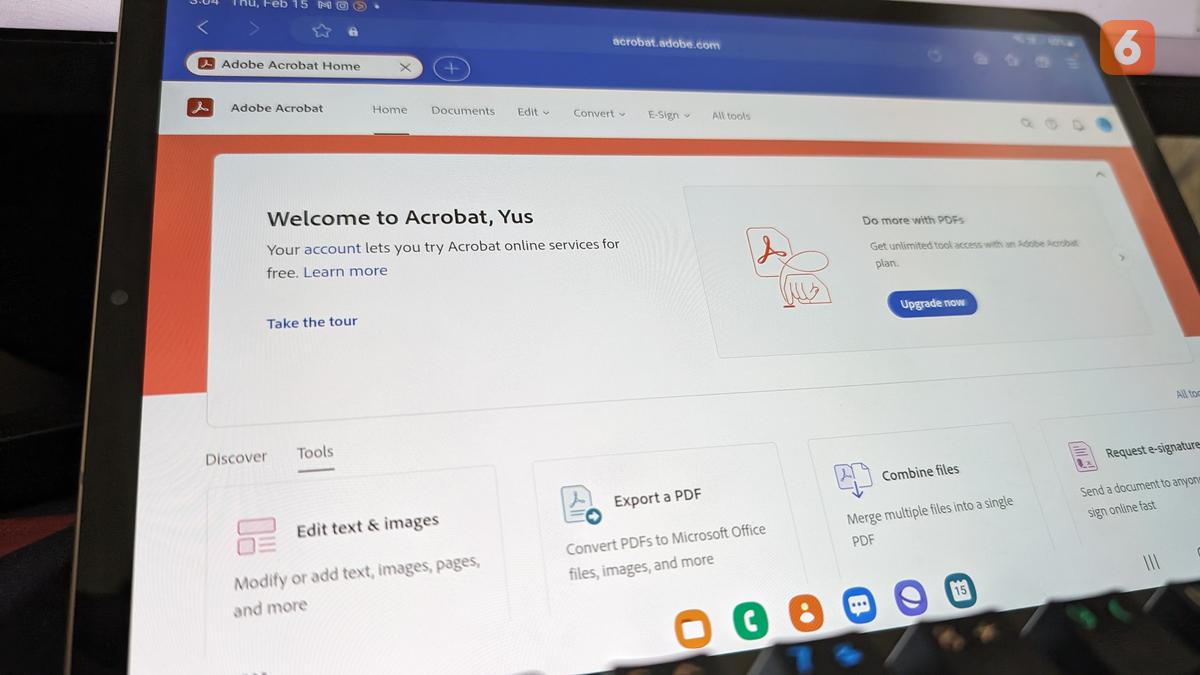

Jakarta – Inilah 5 dokumen penting yang perlu Anda persiapkan untuk mendaftar Beasiswa LPDP 2024. LPDP akan membuka kesempatan kedua melalui Beasiswa LPDP Tahap 2 yang dibuka sekitar bulan Juni 2024. Ada beberapa dokumen yang harus disiapkan untuk Pendaftaran LPDP Tahap 2. ada apa Artikel ini membahasnya, check it out!

5 Dokumen Penting yang Harus Dipersiapkan untuk Daftar Beasiswa LPDP Tahap 2

1. Artikel

Salah satu syarat penting yang harus dipenuhi adalah esai. Esai harus cukup kuat untuk membantu Anda memenuhi syarat untuk beasiswa LPDP. Isi esai harus bermakna dan peserta harus menyertakan hal-hal berikut dalam esai.

Pengenalan diri, pengalaman kerja dan prestasi yang relevan. Komitmen untuk kembali ke Indonesia Rencana kontribusi di Indonesia harus 1500-2000 kata

2. Sertifikat IELTS Bahasa Inggris

Agar memenuhi syarat untuk beasiswa di luar negeri, diperlukan sertifikat tes bahasa yang relevan. Sertifikat bahasa yang diperlukan untuk beasiswa LPDP adalah IELTS. Skor IELTS harus memenuhi persyaratan universitas yang memenuhi syarat. Nilai rata-rata yang disyaratkan secara umum adalah 6,5 – 7,0.

3. Surat rekomendasi

Surat rekomendasi dapat diperoleh dari tokoh masyarakat, akademisi/dosen, atau manajer perekrutan. Jangan lupa untuk memberikan surat rekomendasi yang menjelaskan kualifikasi pelamar dari berbagai sudut pandang. Surat rekomendasi dapat disampaikan melalui dua cara, yaitu surat rekomendasi dalam bentuk online dan surat rekomendasi dalam bentuk offline.

4. LoA (Surat Penerimaan)

Meski tidak wajib, menambahkan LoA dari universitas pada daftar sekolah tujuan LPDP dapat membantu peserta memperoleh poin. Selain itu, jika peserta menandatangani LoA, peserta dapat menjalani tahap opsional yaitu ujian akademik.

5. Dokumen pendukung

Setelah memverifikasi dokumen-dokumen penting di atas, dokumen pendukung berikut ini juga tidak penting dan mungkin bisa menjadi poin tambahan jika Anda melewatkannya.

• Kartu Tanda Penduduk (KTP);

• Pilih ijazah dan transkrip nilai

• Konversi Dokumen Saldo Ijazah dan Indeks Prestasi Kumulatif (IPK) dari Kementerian Pendidikan, Kebudayaan, Riset dan Teknologi (Kmendikbud Ristek) atau Kementerian Agama (Kemenag) untuk lulusan luar negeri. • Surat pendaftaran pada formulir lamaran Surat rekomendasi dari HR Officer (bagi pelamar PNS/TNI/POLRI) Proposal penelitian (bagi pelamar PhD)

JAKARTA – Mantan sutradara film Amerika Steven Spielberg angkat bicara mengenai konflik Israel-Palestina dan anti-Semitisme saat menerima penghargaan dari University of Southern California (USC) di Los Angeles, AS. . Spielberg berbicara pada Senin (25 Maret 2024) di sebuah acara penghormatan atas prestasinya di USC Shoah Foundation.

Yayasan tersebut merupakan organisasi yang didirikan oleh Spielberg pada tahun 1994 untuk merekam dan melestarikan wawancara dengan para penyintas dan saksi mata Holocaust, lapor Arab News, Kamis (28/3/2024).

Sutradara Spielberg mendengarkan cerita para penyintas dan berkata, “Karya sejarah terlihat jelas dalam situasi tersebut”.

Spielberg juga mengatakan bahwa pemikiran ekstremis menciptakan lingkungan yang berbahaya dan menciptakan masyarakat yang tidak menghargai perbedaan. Pria kelahiran 1946 ini mengatakan, setiap hari masyarakat Tanah Air melihat bagaimana cara-cara radikal digunakan di kampus-kampus, dan saat ini mahasiswa menghadapi diskriminasi karena 50% di antaranya adalah mahasiswa Yahudi.

“Hal ini terjadi pada kelompok anti-Muslim, anti-Arab, dan anti-Sikh,” katanya.

Direktur Spielberg mengatakan dia semakin khawatir bahwa orang-orang Yahudi akan sekali lagi memperjuangkan hak mereka untuk menjadi orang Yahudi.

“Kami sangat marah atas tindakan brutal teroris pada tanggal 7 Oktober, dan kami mengutuk pembunuhan terhadap perempuan dan anak-anak yang tidak bersalah di Gaza.” keinginan Jalur Gaza,” kata seorang produser dan sutradara Amerika. , “Pekerjaan Shoah Foundation lebih penting saat ini dibandingkan pada tahun 1994.”

Spielberg sebelumnya memuji film fiksi ilmiah Denis Villeneuve Dune: Part 2. Dalam podcast “Director’s Cut” DGA terbaru, sutradara Spielberg memuji karya Villeneuve.

Sutradara Spielberg adalah pemenang Oscar yang dikenal karena karyanya pada film kulit hitam seperti ET dan Close Encounters of the Third Kind. Mereka yang membuat film terkenal ini menyebut Dune Part 2 sebagai salah satu film fiksi ilmiah terbaik yang pernah mereka tonton.

“Dia membuat salah satu film fiksi ilmiah terhebat yang pernah saya lihat,” kata sutradara berusia 77 tahun itu, seperti dilansir Variety, Kamis (28/3/2024).

bachkim24h.com Edukasi – Komunitas Perkotaan identik dengan pilihan hunian sewa. Selain menghemat biaya, menyewa rumah menjadi solusi kendala finansial. Namun siapa sangka dibalik sisi positif dari menyewa rumah, terdapat dampak kesehatan mengejutkan yang dialami seseorang.

Melaporkan dari Atlas Baru, Senin 16 Oktober 2023, studi baru yang dilakukan para peneliti di Universitas Adelaide di Australia Selatan mengungkapkan bahwa menyewa rumah pribadi berkaitan erat dengan percepatan penuaan biologis, atau penuaan dini.

Para peneliti mengatakan bahwa secara biologis, penyewa lebih tua dari usia sebenarnya. Itu dihitung berdasarkan tanggal dan tahun lahir mereka tanpa memandang usia kronologis. Studi ini menyoroti hubungan antara perumahan sewa dan kesehatan.

Para peneliti menggunakan data survei sosial dan informasi epigenetik, yang mengukur metilasi untai DNA, untuk memahami bagaimana perumahan mempengaruhi kesehatan. Metilasi DNA merupakan modifikasi kimia DNA yang dipengaruhi oleh perilaku dan lingkungan tanpa mengubah kode genetik.

Penelitian ini melibatkan 1.420 responden dari British Family Longitudinal Survey dan British Family Panel Survey. Para peneliti menilai berbagai aspek perumahan, antara lain kepemilikan tanah, jenis bangunan, bantuan keuangan dari pemerintah, dan lokasi perumahan.

Mereka juga mempertimbangkan faktor psikologis seperti biaya perumahan, arus kas dan kemacetan.

Dalam penelitian yang dipublikasikan di Journal of Epidemiology & Public Health ini, peneliti mempertimbangkan faktor lain yang mempengaruhi penuaan biologis. Mulai dari jenis kelamin, pendidikan, status sosial ekonomi, pola makan, stres, kesulitan keuangan, berat badan, dan merokok.

Hasilnya menunjukkan bahwa penyewa mengalami penuaan biologis lebih cepat dibandingkan pemilik rumah. Tingkat pengangguran dua kali lipat dan 50 persen lebih tinggi dibandingkan mantan perokok.

Namun perlu dicatat bahwa tinggal di perumahan umum, dengan biaya rendah dan tingkat keamanan yang tinggi, tidak berdampak signifikan terhadap penuaan biologis, meskipun seringkali menimbulkan stigma sosial. İnul Daratista yang bercerita tentang pengalaman mistik pernah muntah darah, namun İnul Daratista menerimanya dengan sepenuh hati dan mendoakan ibunya baik-baik saja. Baginya doa dan perlindungan ibunya dari Allah SWT sangat penting. bachkim24h.com.co.id 24 April 2024

bachkim24h.com, Jakarta Tak lama setelah mengaku menerima kekerasan fisik dan mental dari seseorang berinisial RI, Nikita Mirzani buka-bukaan langsung di media sosial tentang pentingnya mencintai diri sendiri.

Salah satunya adalah keberanian meninggalkan orang yang mengecewakan. Netizen lantas menduga yang dimaksud Nikita Mirzani adalah Rizki Irmansia, asisten Prabowo Subianto.

“Salah satu bentuk self-love adalah dengan berani melepaskan orang yang mengecewakanmu. Selamat hari Senin, selamat beraktivitas, tulis Nikita Mirzani di Instagram Stories, Senin (15 April 2024).

Nama Rizky Irmansia terseret setelah bintang film Nene Gayung menyebut RI sebagai orang yang pernah ia cintai. Sempat dikabarkan berpacaran dengan Rizki Irmansia, Nikita Mirzani dan asisten Praboro kini saling unfollow.

Dalam live streaming Instagram awal pekan ini, Nikita Mirzani menekankan pentingnya bersuara menentang kekerasan fisik dan mental dalam hubungan, termasuk pacaran dan pernikahan.

“Kalau mental kita terpengaruh, itu akan menghambat kita dalam banyak hal. Jadi harus berani mengambil sikap, harus berani mengambil keputusan, kata pelantun Nikita Gang itu.

Karena ternyata setelah belajar dan membaca, banyak perempuan Indonesia yang tahan terhadap kezaliman laki-laki, baik verbal, perilaku, fisik, lanjut Nikita Mirzani.

Selebritas dengan 12 juta pengikut Instagram ini mengatakan bertahan dalam hubungan yang beracun adalah hal yang tidak bijaksana. Nikita Mirzani mengatakan cinta sejati tidak ada salahnya.

Jika pasangan tega melakukan kekerasan fisik atau menghancurkan mental Anda, maka itu bukan lagi cinta. “Jangan bertahan dalam hubungan seperti itu, karena cinta tidak ada salahnya,” tutupnya.

Diberitakan sebelumnya, Nikita Mirzani menjelaskan status RI disebut-sebut menjadi penyebab kekerasan fisik dan mental dalam hidupnya. RI pernah dicintai. Artinya kini hubungan dengan RI sudah berakhir.

“RI, seseorang yang pernah saya cintai, menjadi sumber kekerasan mental dan fisik dalam hidup saya. “Bekas luka yang tertinggal sangat dalam, namun saya tidak akan membiarkan semua ini mempengaruhi hidup saya,” aku Nikita Mirzani dalam bahasa Inggris.

JAKARTA – Direktorat Jenderal Kebudayaan menyelenggarakan Focus Group Discussion (DKT) oleh Direktorat Pengembangan dan Pemanfaatan Kebudayaan (Kamendikbudristek) Kementerian Pendidikan, Kebudayaan, Riset dan Teknologi.

Kegiatan yang bertujuan untuk mengkaji lebih jauh keterhubungan Jalur Rempah Indonesia dengan India, Timur Tengah, dan Tiongkok ini akan dilaksanakan pada 28-29 Agustus 2023 di Century Park Hotel, Jakarta.

Direktur Pembinaan dan Pemanfaatan Kebudayaan Irini Devi Wanti mengatakan poros global perdagangan rempah-rempah dari Asia, India-Timur Tengah-Kepulauan-Tiongkok melalui perairan India hingga Pasifik telah meninggalkan jejak budaya yang signifikan.

“Jalur Rempah telah mendorong berkembangnya beragam ilmu pengetahuan dan budaya yang menjadi warisan tidak hanya bagi Indonesia, tetapi juga dunia,” ujarnya melalui keterangan tertulis, Senin, 28 Agustus 2023.

Irini menambahkan, kerja sama dengan India, Timur Tengah, dan Tiongkok dalam konektivitas Jalur Rempah sangat strategis untuk menjadikan jalur budaya ini sebagai bagian dari warisan dunia.

“Aliansi ini mencerminkan kesinambungan ikatan kuat antar kawasan selama berabad-abad melalui pertukaran budaya dan ikatan maritim, ekonomi, agama, seni, dan budaya,” ujarnya.

Oleh karena itu, diperlukan kajian yang serius untuk mengetahui sejauh mana hubungan dagang antara masyarakat nusantara dengan bangsa-bangsa di dunia pada masa lalu, apa saja dampak samping dari hubungan tersebut dalam bidang budaya, seni, bahasa, pengetahuan dll.”, lanjutnya.

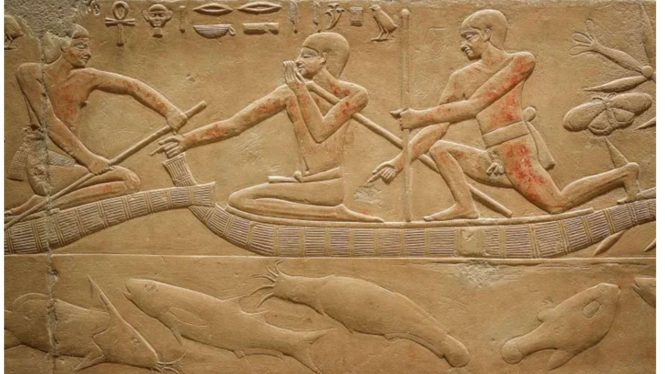

Focus Group Discussion ini diadakan untuk mendalami hubungan nusantara dengan India, Timur Tengah, dan Tiongkok pada masa lalu lalu lintas perdagangan barang dengan menggunakan sumber sejarah temuan arkeologis.

Berbeda dengan masa penjajahan yang tercatat dalam arsip tertulis dan gambar, peristiwa-peristiwa pada masa awal prakolonial Masehi dan Masehi hanya tercatat dalam bentuk narasi lisan yang diturunkan secara turun temurun, prasasti, dan sisa-sisa naskah kuno. , serta temuan arkeologi lainnya”, jelas Irini.

Melibatkan para pakar atau pakar kajian India, Timur Tengah, dan Tiongkok, arkeolog, antropolog, sejarawan, filolog, dan humanis, pembahasannya dibagi dalam topik-topik berikut:

Hubungan nusantara dan India pada masa prakolonial

Diskusi topik ini dihadiri oleh banyak pembicara antara lain I Wayan Ardika (Universitas Udayana), Agus Widiatmoko (BPK Jambi), Rahadhian Dodo (Universitas Parahyangan Bandung) dan Agus Aris Munandar (UI).

Kajian ini berfokus pada interaksi masyarakat nusantara dan India pada awal sejarah, bukti hubungan masyarakat Austronesia dan India yang terjadi jauh lebih awal pada prasejarah, awal masuknya pengaruh budaya India di Asia Tenggara dan nusantara, serta pengenalan dan perkembangan agama Budha dan Hindu di nusantara.

Hubungan Nusantara dan Timur Tengah pada masa prakolonial

Diskusi yang diisi oleh beberapa pakar yaitu Bastian Zullino (FIB-UI), Zaki Khairul Umam (SOAS-London), Harmansyah Yahya (UIN Ereniri Asseh) dan Ari Sudevo (BRIN) mengkaji keterkaitan antara Timur Tengah dan Timur Tengah. Nusantara diawali dengan naskah-naskah Arab, Persia, dan Usmani, baik pra-Islam maupun awal Islam, sumber-sumber filologi dan epigrafi yang menyebutkan hubungan maritim antara Timur Tengah dan nusantara, serta perdagangan barang antara kedua wilayah tersebut.

Hubungan Indonesia-Tiongkok dan Catatan Rempah-Rempah Prakolonial

Pembahasannya terfokus pada kajian interaksi budaya Indonesia dengan Tiongkok yang memberikan pengaruh saling pengaruh, hubungan komersial, politik dan budaya, awal kedatangan masyarakat Indonesia di Tiongkok, proses penerimaan dan hubungan antar keduanya. Kemudian awal mula pengetahuan tentang rempah-rempah Indonesia dari kedua negara, serta berbagai sumber tertulis. Namun di antara pembicara dalam diskusi ini M. Asruchin (mantan duta besar Tiongkok), Yeri Erawan (peneliti) dan Nurni Vahyu Vuryandari (FIB UI) terlibat.

Diselenggarakan selama dua hari, DKT yang terbagi dalam tiga tema ini diharapkan dapat membuahkan beberapa hasil, antara lain gambaran tentang jalur rempah-rempah Indonesia sendiri, sistem dan seluk-beluknya, yang nantinya dapat menjadi bagian pelengkap cerita budaya Indonesia. ; Rekomendasi program dan langkah-langkah yang dilaksanakan untuk mendukung Jalur Rempah Nusantara sebagai Warisan Budaya Dunia, baik di tingkat pemerintah, universitas, maupun masyarakat, dengan melakukan penelitian, seminar dan publikasi komprehensif dengan topik utama Jalur Rempah Nusantara.

“Kami juga berharap diskusi ini akan melahirkan narasi utuh berdasarkan kajian ilmiah yang memperkuat dukungan terhadap pencalonan Jalur Rempah sebagai Situs Warisan Budaya Dunia UNESCO,” pungkas Irini. Sensasinya menemukan fosil ular yang lebih besar dari ukuran T-Rex, seperti itulah rasanya. Ahli paleontologi di Gujarat, India baru-baru ini menemukan fosil ular terbesar di dunia yang masih ada. Ular bernama Vasuki Indicus ini dianggap Lanka bachkim24h.com.co.id 25 April 2024

bachkim24h.com, Jakarta Seluruh umat Islam harus mengetahui tata cara shalat Tahajjud yang benar. Karena tujuan utama shalat tahajud sangat besar bagi umat Islam. Padahal, shalat tahajud merupakan shalat yang paling istimewa.

Sholat tahajjud merupakan amalan sunnah yang sangat dianjurkan Nabi Muhammad SAW kepada umatnya. Disebutkan juga dalam Al-Qur’an bahwa shalat tahajud dapat mengangkat derajat orang yang melaksanakannya ke tempat terhormat di mata Allah SWT.

Tata cara shalat Tahajjud yang benar harus dilakukan sesuai Sunnah. Makna shalat Tahajjud menurut Sunnah sangat mirip dengan shalat pada umumnya. Perbedaan utamanya terletak pada niat, waktu dan jumlah rakaat yang dilakukan.

Berikut bachkim24h.com rangkum dari berbagai sumber, Jumat (31/7/2020) tentang Tata Cara Sholat Tahajud yang Benar

Sebelum mengetahui tata cara melaksanakan shalat Tahajjud yang benar, tentunya Anda perlu mengetahui waktu dan jumlah rakaat yang harus dilakukan terlebih dahulu. Sholat Tahajjud dianjurkan dilakukan pada sepertiga malam. Sholat ini bisa dilakukan di awal, tengah atau akhir malam.

Berikut waktu-waktu salat tahajud:

Sepertiga malam pertama – Dimulai setelah shalat Isya sampai pukul 10.30.

Sepertiga kedua malam – Dari 10.30 hingga 1.30.

Sepertiga terakhir malam – Mulai pukul 01.30 hingga subuh.

Waktu yang paling baik melaksanakan shalat tahajud adalah pada sepertiga malam terakhir.

Berdasarkan hadits dari Abu Hurairah, Rasulullah Shallallahu ‘alaihi wa sallam bersabda:

“Rabi kami – Tabaroka wa Ta’ala – turun setiap malam ke langit bumi dan tetap menjadi malam ketiga. Dan Allah SWT berfirman, “Barangsiapa yang berdoa kepada-Ku, maka Aku akan memberinya pahala. Barangsiapa yang berdoa kepada-Ku, maka Aku akan memberikan kepadanya.

Selain waktu, memahami rakaat juga sangat penting sebelum memahami makna shalat tahajud yang sebenarnya. Sholat sunnah ini dikerjakan 2 rakaat, 2 rakaat dan banyak rakaat. Namun menurut riwayat Bukhari dan Muslim AD, Rasulullah SAW tidak melakukan salat Tahajjud lebih dari 11 sampai 13 rakaat (jumlah rakaat dan butir).

Setelah mengetahui waktu dan jumlah rakaat, Anda pasti bisa menggunakan cara shalat tahajud yang benar. Karena sifat-sifatnya yang sangat baik, dipastikan Anda akan mati jika tidak menjalankan tata cara shalat Tahajud yang benar.

Berikut petunjuk sholat Tahajjud yang benar:

1. Niat shalat tahajud

Ushallii sunnatat-tahajjudi rak’ataini (mustaqbilal qiblati) lillahi ta’aalaa.

Ini berarti:

Aku ingin salat sunah tahajjud dua rakaat (menghadap kiblat) kepada Allah Ta’ala.”

2. Melakukan takbiratul ihram, setelah shalat iftitah

3. Baca Surat Al Fatihah

4. Membaca surat-surat dalam Alquran. Rasullullah SAW membaca surat yang panjang.

5. Rukut dan rukuk dalam shalat pasang surut

6. Saya pasang tuma’ninah sambil membaca doa i’taide

7. Tunduk pada tuma’ninah sambil mengucapkan doa pasrah

8. Ulangi gerakan yang sama seperti rakaat pertama

9. Pada tahiyat terakhir, bacalah doa tahiyat terakhir

10. Buatlah tanda terima kasih.

11. Setelah salam, disunnahkan membaca wirid, tasbih, tahmid, takbir, sholawat, istighfar, kemudian membaca doa tahajud.

Selain melaksanakan amalan salat tahajud yang benar, salat tahajud juga penting. Dalam riwayat Bukhari, Muslim, dan Abu Daud, doa dibacakan di akhir. Doa tersebut mencakup permohonan keselamatan dan kelepasan.

Berikut doanya:

“Allahuma lakal hamdu Anta nuurussamaawaati wall ardli wa man fiihinna. Walakal hamdu Anta qayyimussamaawaati wal ardli wa man fiihinna. Bisa dibilang Anta rabbussamaawaati seumur hidup. wabia khaashamtu wa ilaika haakamtu maa qaddamu wa maa akhchartu wa maa asrartu wa maa a’lantu antal muqaddikhmu wa antal.

Ini berarti:

“Ya Allah, segala puji bagi-Mu, Engkaulah penerang langit dan bumi dan segala isinya, segala puji bagi-Mu, Engkau Penguasa langit dan bumi dan segala isinya, Engkaulah yang segala sesuatu, karena Engkaulah Tuhan, Penguasa langit dan bumi, dan segala isinya. Benar, utus para nabi, utusnya Muhammad (dari-Mu), amal-amal di hari kiamat, wahai Ya Allah, aku taat padamu, aku percaya padamu, aku percaya padamu, dan aku kembali padamu, aku mohon padamu (orang-orang kafir), bersamamu (dan ajaranmu) aku tegaskan hukum Maka ampunilah dosa-dosaku di masa lalu dan di waktu ini yang akan datang, tidak ada Tuhan yang berhak disembah melainkan Engkau saja, Engkaulah Tuhanku, tidak ada Tuhan yang patut disembah selain Engkau.” Doanya terkabul

Nabi Muhammad SAW bersabda: “Rabb kami Tabaraka wa Ta’ala turun setiap malam ke Surga seluruh dunia ketika masih ada sepertiga malam terakhir, lalu beliau bersabda: “Manusia Mintalah ampun kepadaku niscaya Aku akan mengampunimu. setiap. Jika ada yang meminta kepada saya, saya akan memberikannya. dan jika ada yang berdoa kepadaku, aku akan menjawabnya. (HR.Bukhari). Jembatan ke Surga

Berikut sabda Rasulullah SAW saat itu kepada Abdullah Ibnu Muslim tentang manfaat shalat tahajud. “Rakyat! Tebarkanlah keberkahan, bagilah makanan, jalinlah silaturahmi dan amatilah shalat magrib ketika orang lain sedang tidur, niscaya kamu akan masuk surga dengan baik.” (AD. Ibnu Majah) Perbuatan yang akan membantu di akhirat nanti

“Sekarang orang-orang beriman berada di taman surga dan mata air, meletakkan apa yang Allah SWT berikan kepada mereka. Sebelum mereka berbuat baik (di dunia), mereka dizalimi. Berdoalah kepada Allah untuk ampunan.” (QS. Az Zariat : 15-18). Ritual yang dilakukan oleh orang-orang kudus

Sholat Tahajjud adalah ritual shalat. Sebagaimana dijelaskan dalam hadis berikut:

“Teruslah shalat malam karena ini amalan orang-orang yang beribadah sebelum kamu, kamu akan mendekatkan diri kepada Allah, mengampuni dosa, mengusir penyakit, dan mencegah dosa.” (AD.Ahmad). Membina Kesehatan Rohani

Allah SWT telah berfirman, “Hamba-Hamba Allah Yang Maha Penyayang adalah orang-orang yang berjalan dengan tenang di muka bumi, dan orang-orang jahil memberi salam dan berbicara ramah-tamah. Dan orang-orang yang tidur di malam hari, ruku’ dan berdiri di hadapan Tuhannya (QS. Al-Furqan: 63 -64).

JAKARTA – UIN Syarif Hidayatullah Jakarta (UIN Jakarta) berhasil mencatatkan prestasi kelas dunia dengan menduduki peringkat 101-140 dunia dalam QS World University Ranking (WUR) 2024 kategori Teologi, Teologi dan Kajian Keagamaan.

Prestasi ini menempatkan UIN Jakarta sebagai satu-satunya Universitas Islam Regional (PTKIN) yang masuk dalam QS World University Ranking 2024.

Data yang dipublikasikan QS World University Rankings pada topik 2024: Theology, Divinity, & Religious Studies dan dirilis pada Senin (15/04/2024) menunjukkan bahwa peringkat 101-140 pada topik terkait didasarkan pada empat indikator penilaian. Empat diantaranya adalah reputasi akademis (52,9), jumlah sitasi per artikel (89,3), reputasi pemberi kerja (48) dan sitasi indeks H (74,7).

Posisi ini menjadikan UIN Jakarta setara dengan banyak universitas kelas dunia dari berbagai daerah, seperti University of Freiburg di Jerman, Cornell University, Goethe University Frankfurt am Main, Seoul National University dan University of Leipzig. Berbagai universitas tersebut dikenal memiliki praktik akademik yang sangat mapan sejak didirikan.

Misalnya, Universitas Freiburg di Jerman telah menjadi salah satu dari 10 universitas terbaik di Jerman sejak didirikan pada tahun 1457. Demikian pula dengan Universitas Goethe di Frankfurt am Main yang didirikan pada tahun 1914 dan dikembangkan sejalan dengan gagasan Pencerahan dan Perlawanan Eropa. diskriminasi. Demikian pula dengan Cornell University yang telah mengembangkan tradisi akademiknya sejak didirikan pada tahun 1865 di Ithaca, New York, AS.

Di dalam negeri, hanya Universitas Gadjah Mada (UGM) dan Universitas Indonesia (UI) yang menandingi UIN Jakarta di peringkat ini, masing-masing berada di peringkat 61 dan 130 dunia. Sedangkan UIN Jakarta berada di peringkat 122 dan menjadi satu-satunya PTKIN yang masuk dalam pemeringkatan tersebut.

Dengan pencapaian tersebut, pimpinan dan civitas akademika UIN Jakarta mengucapkan terima kasih dan apresiasi yang sebesar-besarnya atas kerja keras seluruh aspek, untuk memenuhi berbagai faktor yang menjadi indikator kedudukannya.

“Alhamdulillah, dalam rangka Ramadhan dan Idul Fitri 1445 Hijriah, UIN Syarif Hidayatullah Jakarta masuk dalam QS World University Rankings 2024 dalam bidang ilmu agama, agama dan kajian agama,” kata Rektor UIN Jakarta Prof. Asep Saepudin Jahar dalam keterangan resminya, Selasa (16/04/2024).

Pengakuan serupa juga disampaikan Rektor Asep Jahar kepada pimpinan Kementerian Agama RI, dengan diperbolehkannya UIN Jakarta mewakili grup PTKIN di tingkat tersebut.

bachkim24h.com, Jakarta – Drama Korea (drakor) slice of life menjadi salah satu genre yang banyak digemari. Dalam drama ini, penonton akan merasakan banyak emosi, mulai dari kesedihan hingga kegembiraan.

Salah satu drama kehidupan yang banyak disukai penonton adalah Our Blues. Drama ini menampilkan aktor-aktor hebat Korea Selatan, seperti Han Ji Min, Shin Min Ah, Lee Byung Hun, Kim Woo Bin dan masih banyak lagi.

Serial yang mengharukan ini mendapat respon yang baik dari para penggemar karena penonton bisa merasakan banyak emosi tanpa pernah merasa bosan.

Nah, jika kamu sedang mencari rekomendasi drama bergenre mirip Our Blues, berikut rekomendasi drama yang patut ditonton, seperti dilansir Times of India, Senin (15/04/2024). 1. Kampung halaman Cha Cha Cha

Hometown Cha Cha Cha merupakan film komedi romantis tahun 2021 yang dibintangi oleh Shin Min Ah, Kim Seon Ho, dan Lee Sang Yi. Drama ini bercerita tentang seorang dokter gigi yang memulai praktiknya di desa nelayan. 2. Selamat datang di Samdalri

Drama ini bercerita tentang seorang fotografer sukses Jo Sam Dal yang jatuh cinta karena sebuah kecelakaan. Dia kembali ke kampung halamannya, tempat yang selalu ingin dia hindari.

Di sini dia bertemu lagi dengan teman masa kecilnya Jo Young Pil, yang merupakan seorang ahli meteorologi. Drama ini dibintangi oleh Ji Chang Wook dan Shin Hye Sun.

Be Melodramatic adalah K-drama yang dibintangi oleh Chun Woo Hee, Jeon Yeo Been, Han Ji Eun, Ahn Jae Hong, dan Gong Myung. Ini menceritakan kisah tiga orang teman berusia dua puluhan dan bagaimana mereka menavigasi pekerjaan dan kehidupan cinta mereka. 4. Karena ini adalah kehidupan pertamaku

This Is My First Life merupakan drama berdurasi penuh yang tayang perdana pada tahun 2017. Dibintangi oleh Jung So Min, Lee Min Ki, Esom, Park Byung Eun, Kim Ga Eun, dan Kim Min Seok.

Drama ini bercerita tentang permasalahan kehidupan orang dewasa dan indahnya persahabatan. Seorang wanita tunawisma dan seorang pria menjadi teman serumah dan berbagi beban hidup.

My Liberation Notes adalah drama bertempo lambat yang dibintangi oleh Kim Ji Won, Son Suk Ku, Lee Min Ki, Lee El, dan Lee Ki Woo.

Drama ini bercerita tentang sebuah keluarga dengan tiga saudara laki-laki yang ingin meninggalkan kehidupan pedesaan dan menetap di Seoul. Bicarakan tentang impian dan aspirasi akan pekerjaan yang baik dan kehidupan cinta.

JAKARTA – Profil Harvey Moeis, suami Sandra Dewi, tersangka kasus korupsi timah tengah disorot. Harvey ditetapkan sebagai tersangka dan ditangkap hari ini, Rabu malam (27/3/2024).

Harvey ditahan Kejaksaan Agung dalam kasus korupsi izin usaha pertambangan atau IUP PT Timah Tbk tahun 2015-2022 yang memperdagangkan komoditas timah di wilayah tersebut. Suami Sandra Dewi juga terlihat keluar dari Kejaksaan dengan mengenakan baju penjara berwarna pink.

Ayah dua anak ini juga terlihat sedang memasang setrika. Harvey tidak hanya tampak dikawal oleh sejumlah pengacara negara saat dia digiring keluar gedung dan masuk ke dalam mobil van yang menangkapnya.

Harvey Moeis merupakan seorang pengusaha kelahiran 30 November 1985. Saat ini usianya sudah 38 tahun, dua tahun lebih muda dari istrinya. Berparas cantik, Harvey merupakan keturunan Papua, Makassar, dan Ambon.

Setelah ayahnya, Hayong Moeis meninggalkannya selamanya karena penyakit kanker, ia tinggal bersama ibunya. Ibunya, Irma Silviani, selalu menjadi kekuatan hidupnya. Bu Harvey dan Sandra Dewi juga memperhatikan dengan seksama. Bahkan, Sandra sering dipanggil Sandra Dewi dengan sebutan Ma Moselle.

Harvey Moeis menikah dengan Sandra Dewi pada 8 November 2016. Pernikahan tersebut menjadi perbincangan publik saat digelar di Tokyo, Jepang dengan tema Cinderella.

Harvey berhasil mewujudkan impian pernikahan Sandra Dewi dengan konsep dongeng di Cinderella’s Castle di Disneyland. Sandra dan Harvey menaiki kereta kuda dan ditemani boneka berkostum khas Disney yaitu Donald Duck dan Mickey Mouse.

Pernikahan tersebut tentu membutuhkan biaya yang tidak sedikit. Acara tersebut juga dihadiri oleh beberapa artis seperti Yuanita Christiani dan Daniel Mananta yang ditunjuk sebagai MC.

Spanyol – Athletic Bilbao melaju ke final Copa do Rei (Piala Raja) setelah mengalahkan Atlético de Madrid 3-0 pada leg kedua semifinal mereka di Stadion San Mamés pada Jumat pagi, 1 Maret 2024.

Ketiga gol tersebut dicetak oleh Inaki Williams, Nico Williams dan Gorka Gurutzeta.

Hasilnya membuat Athletic mengalahkan Atlético dengan agregat 4-0 setelah Bilbao juga memenangkan leg pertama 1-0.

Pada menit ke-13, Inaki Williams membuka skor untuk Bilbao. Hasilnya 1-0.

Bilbao menambah gol untuk menjadikan skor menjadi 2-0 pada menit ke-42. Kali ini Nico Williams menyelesaikan umpan Inaki Williams.

Inaki Williams menyerang dari kanan dan memasuki area penalti. Ia kemudian mengirimkan umpan ke depan gawang dan Nico Williams menyelesaikannya menjadi gol.

Pada menit ke-61, Gorka Guruzeta mencetak gol ketiga Bilbao.

Final Copa del Rey antara Athletic Bilbao dan Real Mallorca dijadwalkan pada 6 April di Stadion Olimpiade di Seville.

Athletic Bilbao (4-3-3-1): Julen Agirrezabala, Inigo Lekue, Aitor Paredes, Daniel Vivian, Oscar de Marcos (Raúl García 89′), Nico Williams, Oihan Sancet (Unai Gómez 80′), Inaki Williams (Alex Berenguer 80′), Benat Prados, Inigo Ruiz de Galarreta (Dani García 68′), Gorka Guruzeta (Yeray Alvarez 89′)

Atlético Madrid (5-4-2): Jan Oblak, Mario Hermoso (Reinildo 53′), Stefan Savic, Axel Witsel, Samuel Dias Lino (Rodrigo Riquelme 72′), Nahuel Molina (Pablo Barrios 54′), Koke, Marcos Llorente, Rodrigo De Paul, Alvaro Morata, Angel Correa (Memphis Depay 54′)

. bachkim24h.com.co.id 22 April 2024

Midea Kembangkan Sayap di Indonesia

Pelabuhan Lampung, 18 Desember 2023 – Midea resmi membuka toko Proshop pertamanya di Lampung, dan upacara tersebut menandai babak baru bagi perusahaan berusia 55 tahun di industri elektronik tersebut, sekaligus menghadirkan pengalaman berbelanja kepada pelanggan.

“Pembukaan Midea Proshop ini merupakan strategi kami untuk mendekatkan diri dengan konsumen Lampung, sekaligus menghadirkan lini produk terkini dan layanan purna jual yang maksimal,” kata Presiden Midea Indonesia Jack Ding dalam keterangan resmi, seperti dilansir bachkim24h.com Tekno.

Didesain dengan ide-ide inovatif dan menggabungkan teknologi canggih dan modern, Midea Proshop Lampung tidak hanya menjadi tempat berbelanja, tetapi juga pusat inspirasi bagi mereka yang mencari solusi rumah pintar.

Pelanggan dapat merasakan langsung fitur-fitur produk, memahami teknologi terkini yang ditawarkan, dan melihat langsung bagaimana produk tersebut dapat meningkatkan kenyamanan hidup sehari-hari.

Midea Proshop Lampung menawarkan berbagai produk AC canggih untuk kebutuhan rumah tangga hingga komersial seperti perkantoran, restoran, dan hotel. Mereka juga menawarkan diskon menarik, hadiah eksklusif, dan keuntungan lainnya.

Selain produk berkualitas dan penawaran spesial, Midea Proshop Lampung mengutamakan dukungan pelanggan melalui tim ahli yang siap membantu memilih produk yang tepat untuk kebutuhan mereka.

Beni Enos, pemilik CV Sarana Sejuk Aircon (perwakilan Proshop), mengatakan: “Midea Proshop tidak hanya fokus pada penjualan, tetapi juga layanan pelanggan, termasuk pemasangan dan pemeliharaan peralatan.” Setuju untuk membatasi impor produk elektronik akhir PT Supertone (SPC) mendukung penuh penerapan peraturan Kementerian Perindustrian mengenai pembatasan impor produk elektronik akhir. bachkim24h.com.co.id 24 April 2024

bachkim24h.com, Jakarta Sumber Toyota mengatakan raksasa mobil Jepang itu telah berkolaborasi dengan Huawei dan Momenta untuk mengembangkan sistem integrasi yang kompleks untuk mobilnya di seluruh dunia. Hal ini akan mendorong peningkatan penggunaan teknologi keamanan dan otomatisasi.

Di sektor EV, Huawei akan menyediakan hardware, dan Momenta akan menyumbangkan software untuk teknologi Toyota. Selain itu, merek Negeri Sakura juga akan mempertahankan kendali atas pengalaman pengguna, melakukan penyesuaian akhir, dan memeriksa integrasi.

Selain itu, kemitraan ini bertujuan untuk meningkatkan teknologi bantuan pengemudi dan pada akhirnya meningkatkan jajaran produk Toyota ke tingkat otonomi yang lebih tinggi.

Pengumuman resmi mengenai kolaborasi ini akan diumumkan pada Beijing Auto Show tahun ini.

Toyota sebelumnya bermitra dengan Huawei untuk teknologi kabin pintar dan sistem kendaraan terhubung. Selain itu, Toyota juga mendukung pendanaan Seri C Momenta, yang menjelaskan mengapa perusahaan tertarik menggunakan teknologinya.

Sementara bagi Toyota, meningkatkan kehadirannya di pasar China sangatlah penting. Saat ini Toyota sendiri memiliki dua mobil listrik di China yakni bZ3 dan bZ4X. Namun penjualan keduanya tidak berjalan baik.

Penerapan sistem penggerak cerdas yang canggih berpotensi mendefinisikan kembali citra Toyota sebagai produsen mobil yang paham teknologi, yang sangat penting untuk memperkuat daya saingnya di pasar kendaraan listrik yang berkembang pesat.

Toyota Motor Corporation (TMC) mengumumkan niatnya untuk mengubah peran dan tanggung jawab TMC dan Daihatsu Motor Corporation (DM) untuk perusahaan mobil kecil di pasar negara berkembang.

Selain itu, seiring dengan perubahan strategi tersebut, TMC juga akan mengganti nama Toyota Motor Asia Pacific (TMAP) yang berbasis di Singapura, dan Toyota Daihatsu Engineering and Manufacturing (TDEM) yang berbasis di Thailand, menjadi Toyota. . . Motor Asia.

Namun tanggal detail nama baru perusahaan tersebut belum diumumkan dan akan segera dikonfirmasi.

Dengan adanya perubahan nama perusahaan ini mempunyai tujuan yang sangat besar yaitu untuk membatasi

bachkim24h.com, JAKARTA – Dokter spesialis penyakit dalam dari Advanced Diabetes Center Rumah Sakit Dr. Rumah Sakit Pusat. Cipto Mangunkusumo dr. Farid Kurniawan, Sp.PD, Ph.D mengimbau masyarakat untuk mengontrol kadar gula darah setelah lebaran agar terhindar dari risiko diabetes.

“Tetap harus mengontrol glukosa darah (kadar gula),” kata Farid saat webinar “Menangani Diabetes Setelah Puasa dan Idul Fitri” yang digelar di Jakarta, Sabtu (20 April 2024) agar tetap sehat. ).

Baik bagi masyarakat sehat maupun penderita diabetes, Farid mengingatkan untuk mengontrol asupan makanan setelah lebaran, terutama makanan yang dapat meningkatkan kadar gula darah dalam tubuh. Farid mengatakan, orang sehat tetap berisiko mengalami hipoglikemia atau hiperglikemia akibat makanan tinggi gula.

“Konsumsi kalori lebih tinggi, konsumsi gula lebih tinggi, akhirnya kadar gula darah jauh lebih tinggi dari sebelumnya.” “Kalau dilanjutkan, gula darahnya akan meningkat,” ujarnya.

Kadar gula darah dapat dikontrol dengan menjaga pola makan sehat dan makan sesuai jadwal. Pola makan sehat dapat dikelola dengan menerapkan 3J yaitu jadwal, jumlah dan jenis makanan yang ditentukan berdasarkan usia, jenis kelamin, berat badan, tinggi badan, dan aktivitas fisik sehari-hari.

Masyarakat sebaiknya memilih makanan dengan indeks glikemik rendah, seperti makan sayur, untuk memenuhi kebutuhan serat. Selain itu, masyarakat juga perlu memperhatikan pedoman takaran saji Kementerian Kesehatan, yaitu setiap piring berisi setengah sayur dan buah, seperempat berisi protein, dan seperempat berisi sumber karbohidrat.

Yang tak kalah penting adalah aktivitas fisik melalui olahraga untuk menjaga keseimbangan antara asupan kalori dan asupan kalori, meningkatkan resistensi insulin, dan mengoptimalkan pengendalian gula darah.

“Jika Anda mengonsumsi banyak kalori, berarti Anda harus menyeimbangkannya dengan banyak berolahraga.” “Menghabiskan waktu untuk berolahraga akan lebih membantu menstabilkan gula darah Anda,” kata Farid.

bachkim24h.com, PARIS – Kylian Mbappe berang ketika bos Paris Saint-Germain Luis Enrique berhasil menjatuhkannya dalam kemenangan derby 2-0 atas Marseille pada menit ke-64. Superstar Prancis itu menjadi kapten Orange Velodrome untuk Le Classique pada Minggu malam (31/3/2024) WIB. Namun, karena PSG unggul satu gol dan kehilangan satu pemain, Enrique memilih menarik sang striker dan menggantikannya dengan Goncalo Ramos.

Mbappe tampak terkejut dengan keputusan tersebut, gemetar saat melihat nomornya muncul di papan. Pemain Prancis itu terus berteriak sambil berjalan keluar lapangan.

Setelah sebagian besar duduk di bangku cadangan, Mbappe langsung menuju terowongan bersama Ousmane Dembele. Enrique dengan tegas mempertahankan keputusannya setelah peluit akhir dibunyikan, menegaskan dia tidak akan meminta maaf.

“Musiknya sama setiap minggu, musik yang sama… sangat membosankan. Saya manajernya, saya mengambil keputusan setiap hari, setiap minggu. Saya akan melakukan hal yang sama hingga hari terakhir saya di Paris,” kata Enrique, disebutkan. . dengan Cermin, Senin (1/4/2024).

Ia memastikan keputusan yang diambilnya adalah yang terbaik untuk tim. “Saya selalu berusaha mencari solusi terbaik untuk tim saya. Saya pikir saya benar. Sekalipun Anda tidak (mengerti), saya tidak peduli. Saya tidak peduli sama sekali. Hari ini kami melakukan terlalu banyak hal. Itu bagian dari sepak bola, kami harus menerimanya dan terus maju,” ujarnya.

Namun, Mbappe jelas masih merasa tidak senang dengan mengunggah foto buram dirinya di Instagram dengan punggung menghadap kamera. Peran tersebut juga tidak memiliki judul dan Mbappe tidak berbicara kepada media.

Sebelum pergantian pemain, PSG sempat bermain dengan 10 pemain setelah bek Lucas Beraldo dikeluarkan dari lapangan karena menjatuhkan Pierre-Emerick Aubameyang. Meskipun mereka melihat Beraldo tampil lebih awal, PSG masih memimpin.

Vitinha melepaskan tembakan mendatar melewati kiper Marseille Pau Lopez untuk membuka skor bagi tim tamu tujuh menit setelah turun minum. Tuan rumah mengira mereka telah menyamakan kedudukan delapan menit kemudian. Jordan Veretout mencetak gol pada menit ke-60. Namun gol tersebut akhirnya dianulir oleh VAR setelah Luis Henrique menilai kiper PSG Gianluigi Donnarumma dilanggar.

Enrique membuat keputusan kontroversialnya untuk mengeluarkan Mbappe hanya tiga menit kemudian. Namun keputusannya tampaknya tepat ketika Ramos mencetak gol empat menit menjelang pertandingan usai untuk mengamankan kemenangan tim tamu.

bachkim24h.com, Jakarta Harga emas yang dijual PT Pegadaian (Persero) atau harga emas gadai mengalami kenaikan pada perdagangan Selasa (16/04/2024). Harga emas agunan jenis kompak Antam dan UBS lebih tinggi dibandingkan kemarin.

Dikutip dari situs resmi Pegadaian, harga emas Pegadaian per 1 gram Antam saat ini adalah Rp 1.348.000. Harga emas Antam di Pegadaian naik dari perdagangan kemarin yang dipatok Rp 1.343.000.

Harga emas UBS kembali menguat, 1 gramnya dipatok Rp 1.321.000.

Bagi yang suka beli emas di Pegadaian harus tahu bahwa harga logam mulia selalu berubah-ubah sesuai pasar. Masyarakat bisa langsung mengikuti detail harga emas 24 karat Pegadaian melalui situs resminya.

Berikut daftar harga emas Pegadaian saat ini: Harga Emas Antam Harga Emas Antam Hari Ini 0,5 gram: Rp 726.000. Harga emas Antam 1 gram hari ini: Rp 1.348.000 Rp. Harga emas Antam 2 gram hari ini: Rp 2.635.000 Rp. Harga emas Antam 5 gram: Rp 6.509.000. Harga emas Antam 10 gram saat ini: Rp 12.962.000. Harga emas Antam 25 gram saat ini: Rp 32.275.000. Harga emas Antam 50 gram saat ini: 60 gram: 60 gram Rp 128.855.000. Harga Emas Antam Saat Ini 250 Gram : Rp 321.866.000 Harga Emas Antam Saat Ini 500 Gram : Rp 643.516.000 Harga Emas Antam Saat Ini 1000 Gram : Rp 1.286.990.000 Harga Emas UBS Terbaru 0,5 Gram Harga Emas UBS 2.000 Harga Emas UBS 1.000,00 0 Harga Emas UBS 2 Gram Terbaru : s 2.62 0,000 Emas UBS 5 Gram Terbaru Harga: Rs 6.473.000 Harga Emas UBS 10 Gram Terbaru: Rs 12.879.000 Harga Emas UBS 25 Gram Terbaru: Rs 32.131.000 Harga Emas UBS 50 Gram: Rs 64.130 Harga Emas UBS Terbaru: Rs 64.130.000 Rs 128,2 07.000 Harga Emas UBS Terbaru 250 Gram : Rs 320.424.000 Harga Emas UBS Terbaru 500 gram : Rs.640.091.000.

Harga emas menguat pada perdagangan Senin (Selasa waktu Jakarta) didorong permintaan zona aman yang dipicu ketegangan Iran dan Israel di Timur Tengah.

Harga emas global melonjak meskipun dolar AS dan imbal hasil Treasury meningkat setelah peningkatan penjualan ritel AS yang lebih kuat dari perkiraan pada bulan Maret, memicu kekhawatiran bahwa bank sentral AS dan Federal Reserve akan melambat. suku bunga yang lebih rendah.

Harga emas di pasar spot naik 0,9% menjadi $2,365.09 per ounce pada Selasa (16/04/2024), setelah mencapai rekor tertinggi $2,431.29 pada perdagangan Jumat, menurut ekspektasi serangan balasan Iran terhadap Israel.

Sementara itu, emas berjangka AS naik 0,4% menjadi $2,383.

Bart Melek, kepala strategi komoditas di TD Securities, mengatakan hal ini adalah pergerakan harga yang didorong oleh geopolitik dan dapat dikaitkan dengan pernyataan Pasukan Pertahanan Israel bahwa sesuatu akan segera terwujud.

Iran meluncurkan drone dan rudal bermuatan bahan peledak pada Sabtu malam dalam serangan pertama terhadap Israel oleh negara lain dalam lebih dari tiga dekade, yang memicu kekhawatiran akan konflik regional yang lebih luas.

Dolar naik 0,2% dan imbal hasil Treasury 10-tahun mencapai level tertinggi dalam lima tahun setelah data menunjukkan penjualan ritel AS naik lebih dari yang diharapkan pada bulan Maret, bukti lebih lanjut bahwa perekonomian melemah pada kuartal pertama

Pasar kini melihat kurang dari dua pemotongan sebesar 25 basis poin pada akhir tahun, setelah sebelumnya memperkirakan tiga basis poin.

“(Namun) dalam jangka pendek, harga emas bisa turun hingga $2.200 karena premi geopolitik menghilang,” kata Daniel Pavilonis, ahli strategi pasar senior di RJO Futures.

bachkim24h.com, Jakarta Membaca Alquran adalah salah satu amalan yang paling dianjurkan dalam Islam. Selain sebagai ibadah, membaca Al-Quran juga dapat menjadi sumber kenyamanan dan semangat dalam menjalani kehidupan sehari-hari. Al Quran mengandung banyak permata yang berkaitan dengan aktivitas membaca Al Quran. Kata-kata mutiara tentang membaca Alquran tidak hanya menjadi inspirasi, tetapi juga mengingatkan umat Islam untuk selalu mendekatkan diri kepada Allah dengan membaca firman-Nya.

Kumpulan ucapan tentang membaca Alquran ini bisa menjadi panduan bagi umat Islam dalam kehidupan sehari-hari. Kata-kata mutiara ini dapat mengajarkan kita untuk selalu menghadirkan Al Quran dalam setiap langkah dan tindakan. Membaca Al Quran akan menenangkan hati dan menjernihkan pikiran.

Dalam kehidupan yang penuh tantangan, membaca Al Quran menjadi kekuatan yang luar biasa. Kata-kata mutiara tentang membaca Al Quran mengingatkan kita untuk selalu memperhatikan ayat-ayat Allah dan mengamalkannya dalam kehidupan sehari-hari. Dengan demikian, pikiran dan hati kita akan menjadi lebih tenang, tenteram dan penuh cinta kasih. Dalam situasi apa pun, membaca Al-Quran akan memberi kita kebahagiaan dan kesuksesan sejati.

Sebagai informasi, berikut dihimpun bachkim24h.com dari berbagai sumber kumpulan kata-kata mutiara tentang membaca Alquran pada Rabu (24/4).

Membaca Al-Qur’an merupakan salah satu ibadah yang paling dianjurkan bagi umat Islam. Al-Qur’an merupakan kitab suci umat Islam yang berisi tuntunan hidup dan ajaran agama. Ketika kita membaca Al Quran, kita mendapatkan banyak manfaat dan ilmu dari setiap ayatnya. Itulah sebabnya kata-kata mutiara tentang membaca Al Quran begitu berharga dan layak untuk dipahami. Berikut kumpulan 25 mutiara tentang membaca Al-Quran:

1. “Bacalah Al Quran, karena itu akan menjadi penerang hidupmu.” -Omar bin Khatab

2. “Perbanyaklah membaca Al-Qur’an, karena dialah yang akan menjadi pendamping setiamu di surga.” -Abdullah bin Umar

3. “Bacalah Al-Quran dengan hati yang tulus, karena hanya dengan hati yang tulus kita dapat menyadari kemuliaannya.” -Ali bin Abi Thalib

4. “Bacalah Al-Quran secara perlahan, karena setiap suku kata yang diucapkan akan membawa kebaikan.” -Ali bin Abi Thalib

5. “Membaca Al-Quran adalah cara terbaik untuk menemukan ketenangan pikiran.” -Abu Bakar

6. “Membaca Al-Quran adalah salah satu cara mendekatkan diri kepada Allah.” -Utsman bin Affan

7. “Luangkan waktu untuk membaca Al Quran ditengah kesibukanmu, karena hanya dengan itulah kita bisa merasakan kedamaian dan ketenangan hati.” – Aisyah binti Abu Bakar

8. “Dengan membaca Al-Quran kita bisa mendapatkan pedoman hidup yang benar dan jelas.” -Hassan al-Bashri

9. “Bacalah Al-Quran dengan hati terbuka, karena setiap perkataan yang diucapkan akan membuka pintu rahmat Allah.” – Ibnu Qayyim al-Jawziyyah

10. “Bacalah Al-Qur’an dengan penuh penghayatan, karena hanya dengan itulah kita dapat memahami makna yang terkandung di dalamnya.” – Imam al-Ghazali

11. “Membaca Al-Quran adalah senjata terbaik melawan godaan setan.” — Imam Syafi’i

12. “Bacalah Al-Quran dengan akhlak yang baik, karena hanya dengan itulah kita dapat meneladani ajaran yang ada di dalamnya.” -Imam Nawawi

13. “Setiap kita membaca Al-Quran, kita mendapat pahala yang berlipat ganda.” — Imam Syafi’i

14. “Bacalah Al-Quran dengan hati yang benar dan rendah hati, karena hanya dengan itulah kita dapat merasakan kehadirannya di setiap ayat yang kita baca.” – Imam Al-Haddad

15. “Ada hikmah dan keajaiban di setiap ayat Al-Qur’an yang patut kita renungkan.” – Imam al-Qurtubi

16. “Membaca Al-Quran adalah investasi terbaik untuk masa depan kita dalam waktu dekat.” – Imam Ibnu al-Jawzi

17. “Bacalah Al-Quran dengan tajwid yang benar, karena hanya dengan itulah kita dapat memahami makna sebenarnya.” – Imam as-Syakani

18. “Perhatikanlah setiap ayat Al-Qur’an yang kita baca, karena di dalamnya terkandung tuntunan hidup yang sempurna.” – Imam al-Mawardi

19. “Bacalah Al-Quran dengan hati terbuka dan jiwa tenang, karena dibalik setiap huruf yang dibaca terdapat mukjizat yang menakjubkan.” – Imam al-Baqilani

20. “Membaca Al-Quran adalah pelita kehidupan, karena hanya melaluinya kita dapat menerangi setiap langkah.” – Imam Ibnu Qudamah

21. “Dengan membaca Al-Quran kita dapat menjaga diri dari kecerobohan dan kesalahan.” — Ibnu Taimiyyah

22. “Bacalah Al-Quran dengan penuh keikhlasan, karena hanya dengan itulah kita bisa merasa bersyukur kepada Allah.” -Imam Malik

23. “Membaca Al-Quran adalah obat jantung yang paling mujarab.” – Ibnu Qayyim al-Jawziyyah

24. “Bacalah Al-Quran dengan hati gemetar, karena hanya dengan itulah kita dapat merasakan kehadirannya di setiap sudut hati.” -Imam Nawawi

25. “Membaca Al-Qur’an adalah olah raga terbaik yang bisa kita lakukan, karena hanya dengan membaca kita bisa mendapatkan kebahagiaan sejati dunia dan akhirat.” – Imam al-Ghazali

Membaca Al-Quran merupakan amalan yang memiliki banyak keutamaan dalam agama Islam. Membaca Al Quran bukan sekedar membaca huruf demi huruf, namun memahami makna dan pesan yang ada di dalamnya. Para tokoh agama Islam yang menjadi teladan bagi umat Islam juga menawarkan kata-kata mutiara tentang membaca Al-Qur’an yang dapat memberikan inspirasi dan motivasi dalam menyelesaikan kegiatan membaca Al-Qur’an. Berikut 25 kata mutiara tentang membaca Al Quran dari statistik:

1. “Saat membaca Al Quran, bukalah hati untuk menyerap segala informasi yang dikandungnya.” – Ustad Yusuf Mansur

2. “Perbanyaklah membaca Al-Quran, karena di dalamnya terkandung obat segala penyakit jantung.” – Al-Hassan Al-Bashari

3. “Al Quran tidak hanya sekedar dibaca tetapi juga diamalkan dalam kehidupan sehari-hari.” – Habib Umar bin Hafiz

4. “Membaca Al-Qur’an seperti berbicara langsung dengan Tuhan. Jangan pernah bosan dan teruslah berkomunikasi melalui Al-Qur’an.” -Ustad Adi Hidayat

5. “Dengan membaca Al Quran segala kebutuhan hidup akan tercukupi dengan baik.” – Dr. Zakir Naik

6. “Hati yang terasa kosong akan terisi bila membaca dengan Al Quran.” – K.H. Abdullah Majelis

7. “Membaca Al-Qur’an merupakan tanda bahwa umat Islam selalu menjadi bagian dari panji keberkahan dunia dan akhirat.” – K.H. Mustofa Bisri

8. “Al-Qur’an adalah pelita hidup. Dengan membacanya kita akan berjalan di jalan yang terang.” – K.H. Anwar Zahid

9. “Membaca Al-Qur’an menuntun kita menuju kehidupan yang benar. Kita akan menemukan panduan hidup yang jelas di dalamnya.” – Guru Felix Siauw

10. “Jangan jadikan Al Quran hanya sekedar hiasan rumah, tapi jadikan Al Quran sebagai pedoman hidupmu.” – Dr. Muhammad Arifin Badri

11. “Al-Qur’an adalah sahabat sejati setiap Muslim. Jalin keakraban dengannya dengan membacanya setiap hari.” -Tuan Nauman Ali Khan

12. “Membaca Al Quran membantu kita meningkatkan pemahaman dan pengetahuan kita tentang Islam.” – Guru Abdul Somad

13. “Membaca Al Quran membantu kita menjalani hidup dengan rasa syukur dan bertawakal kepada Allah.” -Ustadz Firanda Andirja

14. “Hidup ini hanya sementara, namun Al-Qur’an merupakan petunjuk menuju kehidupan yang kekal.” – Ustad Ahmad Zainuddin LC

15. “Jadikan Al Quran sahabat setiamu, karena tidak hanya mengajarkan agama tapi juga memberikan rasa cinta kepada Allah.” – Tuan Hanan Ataki

16. “Membaca Al-Quran untuk menambah pengetahuan tentang Islam, sehingga kita dapat mempunyai kehidupan yang baik.” -Ustaz Abdullah Zain

17. “Nilai Al-Quran tidak bisa dinilai dari isinya, tapi dari kerja keras yang dilakukan untuk membaca dan mengamalkannya.” – Ustad Abdul Hakeem bin Amir Abdat

18. “Nanti ketika kita di hadapan Allah, Al-Qur’an menjadi saksinya.” – Ustaz Abdullah AA Pesenam

19. “Membaca Al-Qur’an akan memberi kita ketenangan pikiran dan ketenangan yang unik.” -Ustad Khalid Basalma

20. “Al-Qur’an adalah obat hati yang mampu menyembuhkan segala penyakit jiwa manusia.” – Guru Abdul Somad

21. “Membaca Al Quran dengan ikhlas ibarat menabur benih kebaikan dalam diri kita.” -Ustad Adi Hidayat

22. “Al-Quran adalah sumber cahaya bagi orang-orang Islam yang membacanya dengan penuh keimanan.” – Dr. Muhammad Qureish Shihab

23. “Membaca Al-Quran tidak hanya dapat memperdalam ilmu agama, tetapi juga membuka pintu karir yang tidak terduga.” – Ustad Yusuf Mansur

24. “Jadikan Al Quran sebagai pendamping setiamu, niscaya dia akan membimbingmu dalam setiap langkah hidupmu.” – Habib Luthfi bin Yahya

25. “Membaca Al-Quran adalah obat bagi hati yang terluka dan obat bagi jiwa yang gelisah.” – Tuan Hanan Ataki

Sumber tentang membaca Al Quran Data di atas diharapkan dapat memotivasi umat Islam dalam melakukan kegiatan membaca Al Quran. Semoga dengan memahami pesan yang terkandung dalam Al Quran, kita dapat meningkatkan keimanan dan ketakwaan kita terhadap Allah SWT.

bachkim24h.com, Jakarta PLN Energi Primer Indonesia (PLN EPI) melakukan berbagai perubahan untuk mengembangkan bisnisnya, salah satunya membantu biomassa untuk berkontribusi terhadap perekonomian masyarakat dan perubahan di masa depan yang kuat.

Direktur Utama PLN EPI Iwan Agung Firstantara mengatakan melalui pembangunan organik, PLN EPI berkomitmen membantu mencapai Net Zero Emissions (NZE) 2060, membantu pemerintah daerah untuk menghilangkan sampah kota dan meningkatkan perekonomian masyarakat.

“Meningkatkan perekonomian masyarakat dengan pengelolaan EPI PLN melalui minyak jamputan (BBJP), serta limbah pertanian dan pertanian seperti limbah kayu, limbah jagung, limbah enau, dan bahan-bahan lain yang bersifat biomassa, dengan penekanan kuat pada biomassa. , Selasa (12/3/2024). Memperbarui

Menurut Ivan, PLN EPI akan terus berkembang dan berinovasi agar Substrat PLN mampu bersaing secara global dalam penyediaan energi dan menjadi organisasi yang bisa dibanggakan Indonesia.

Kedepannya PLN EPI akan lebih banyak melakukan pembaruan dan berbagai perubahan lainnya, kata Iwan.

Kiprah PLN EPI dalam mendorong biomassa juga membuahkan hasil, dengan diselenggarakannya BUMN Corporate Communication and Sustainability Conference (BCOMSS) tahun 2024 yang meraih peringkat pertama dalam Media Relations Management Award.

Menurut Iwan, PLN EPI menjadi satu-satunya BUMN substrat yang mampu memperoleh penghargaan komunikasi pada BCOMSS 2024 di bidang pengelolaan komunikasi (yang dilaksanakan sesuai prinsip SMART ( Spesifik, Measurable, Achievable, Relevant dan Timely).

PT PLN (Persero) melalui PT PLN Energi Primer Indonesia (PLN EPI) bersedia terus memperkuat program pembakaran organik di pembangkit listrik (PLTU). Hal ini merupakan salah satu upaya untuk mencapai tujuan Net Zero Emissions (NZE) pada tahun 2060.

Direktur Utama PLN EPI Iwan Agung Firstantara mengatakan salah satu komitmen perseroan adalah pengembangan energi biomassa untuk menyediakan sumber energi alternatif selain batu bara.

Iwan mengatakan di Jakarta, Rabu (6/3/2024) bahwa pengembangan energi biomassa dan komitmen PLN dalam mengurangi konsumsi karbon melalui program cofiring PLTU, program cofiring PLTU dilaksanakan oleh PLN Group sejak tahun 2018. Hingga tahun 2022, penerapan cofiring PLTU telah diterapkan pada 36 unit PLTU dengan produksi energi bersih hingga 575,4 GWh dengan pengurangan CO2e sebesar 570.000 ton.

Menurut Ivan, perusahaan terus berkomitmen terhadap pengembangan organik. Salah satunya adalah peluncuran Program Efisiensi Energi yang diluncurkan pada Februari 2023 bersama Keraton Yogyakarta.

Saat itu PLN EPI menanam 50.000 bibit kuat dan pada 22 Februari 2024 PLN EPI menanam 50.000 bibit lagi, kini PLN EPI sudah menanam 100.000 bibit kuat.

Program tersebut meliputi penanaman sejumlah tanaman di Desa Gombang, Kecamatan Ponjong, Kabupaten Gunung Kidul, DI Yogyakarta.

Tanaman yang ditanam antara lain Gamal, Kaliandra Merah, Indigofera, dan Gmelina sebanyak 50.000 bibit, 6.200 bibit Gamal, 22.400 bibit Indigofera, 7.200 bibit Gmelina, dan 14.200 bibit Kaliandra Merah, jelas Idwans.

Ivan menambahkan, dalam Program Pemberdayaan Masyarakat ini, PLN EPI juga menyertakan partisipasi masyarakat. 50.000 benih disebar di dua lingkungan, masing-masing ditemukan 25.000 tanaman.

Dari jumlah tersebut, sebanyak 15.000 bibit pohon ditanam di lahan kas desa dan tanah sultan seluas rubu m2 atau 30 hektar dengan tinggi pohon 1 meter antar pohon. Sebanyak 10.000 pohon kecil ditanam di ladang atau pekarangan warga, dimana setiap orang atau keluarga mendapat 9-12 pohon.

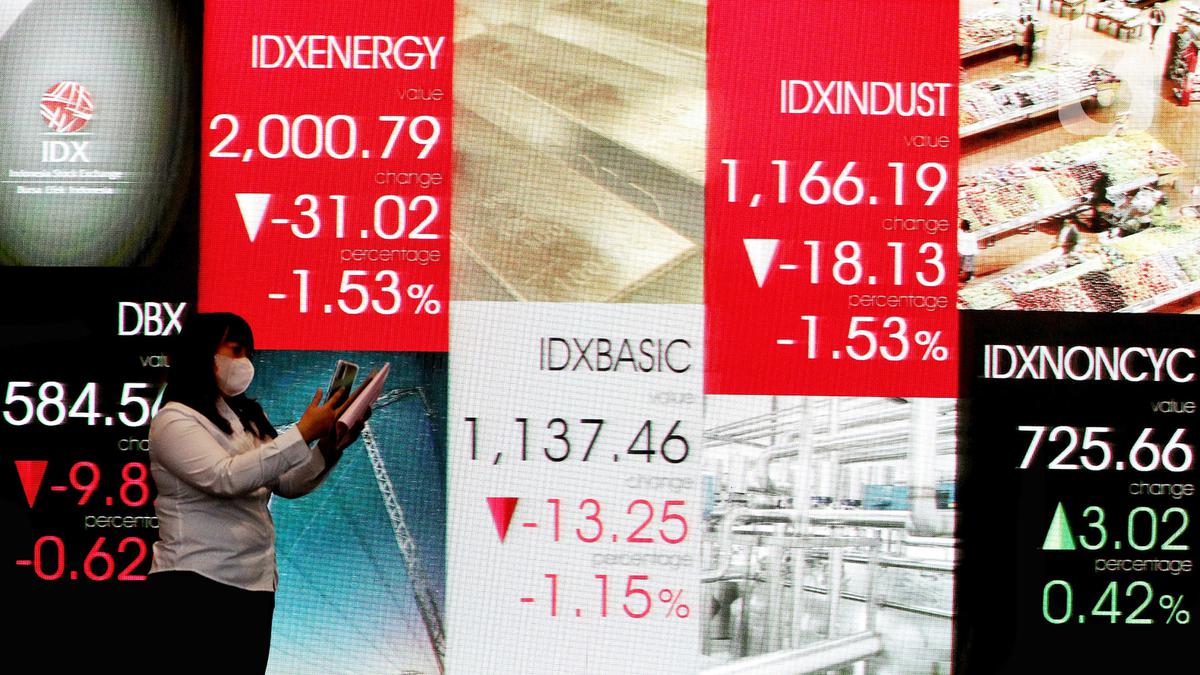

bachkim24h.com, Jakarta – PT Medco Energy International TBK (MEDC) akan membeli satu saham dengan harga pembelian maksimal Rp 200 miliar atau setara US$12,50 juta (dengan asumsi kisaran US$16.000 terhadap rupiah).

Mengutip keterbukaan informasi Bursa Efek Indonesia (BEI) pada Selasa 19 April 2024 (23/4/2024), PT Medco Energy International Tbk memperkirakan pembelian tersebut berjumlah 100 juta saham atau 0,398 persen dari saham yang diterbitkan perseroan. Berarti modal disetor. Dengan demikian, jumlah tersebut tidak akan melebihi 10 persen saham perseroan, termasuk saham treasury yang ada.

“Sumber dana yang digunakan sebagai pengeluaran pembelian kembali saham Perseroan bukanlah dana yang diperoleh dari penawaran umum, juga bukan dana yang dihasilkan dari pinjam meminjam dalam bentuk apapun,” tulis perseroan.

Manajemen Medco International mengatakan, tindakan payback tersebut untuk meningkatkan return on equity (ROE) perseroan. Selain itu, pembelian kembali saham akan memberikan perusahaan fleksibilitas yang lebih besar dalam pengelolaan modal dan pengembalian maksimum kepada pemegang saham.

“Mengingat pertumbuhan dan perluasan bisnis perseroan, pembelian kembali saham juga akan memfasilitasi pengembalian tambahan uang tunai dan kekayaan kepada pemegang saham secara efektif dan efisien,” tulis perseroan.

Selain itu, perseroan dapat menggunakan saham hasil buyback tersebut untuk mendanai program kepemilikan saham bagi karyawan dan manajemen perseroan. Perseroan akan mematuhi ketentuan yang berlaku mengenai pengalihan saham akibat pembelian kembali.

Perseroan juga berharap pembelian kembali saham tersebut tidak berdampak negatif terhadap pendapatan. Pasalnya, perusahaan memiliki modal kerja dan arus kas yang cukup untuk melakukan pembelian tersebut.

Periode pembelian saham adalah dari tanggal 31 Mei 2024 sampai dengan 30 Mei 2025, dalam waktu 12 bulan setelah tanggapan RUPS. Perseroan akan menyelenggarakan Rapat Umum Pemegang Saham Tahunan (RUPST) pada 30 Mei 2024.

Untuk melaksanakan operasi pembelian kembali tersebut, Medco Energy International telah menunjuk PT BRI Danarexa Securitas untuk membeli saham perseroan melalui perdagangan di BEI.

Harga saham MEDC stabil di Rp 1.480 per saham pada penutupan perdagangan Selasa 23 April 2024. Harga saham MEDC dibuka menguat lima poin di Rp 1.485 per saham. Saham MEDC mencapai level tertinggi Rp 1.500 dan terendah Rp 1.465 per saham. Total frekuensi perdagangan sebanyak 4.954 kali dengan volume perdagangan 248.098 lembar saham. Nilai transaksinya sebesar Rp 36,8 miliar.

Sebelumnya diberitakan, PT Medco Energy International Tbk (MEDC) melaporkan penurunan pendapatan dan laba pada tahun 2023.

Mengutip laporan keuangan yang disampaikan ke Bursa Efek Indonesia (BEI) pada Kamis (11/4/2024), PT Medco Energy International Tbk meraih pendapatan sebesar US$2,24 miliar pada tahun 2023. Pendapatan pada tahun 2022 USD turun 2,7 persen dibandingkan periode tahun 2022. 31 juta.

Beban pendapatan dan belanja langsung lainnya meningkat sebesar 14,02 persen dari US$1,06 miliar pada tahun 2022 menjadi US$1,21 miliar pada tahun 2023. Dengan demikian, laba kotor turun 17,04 persen dari US$1,24 pada tahun 2022 menjadi US$1,03 pada tahun 2023.

Perseroan menyebutkan laba sebelum pajak dari operasi yang dilanjutkan turun 30,42 persen menjadi US$727,85 miliar pada tahun 2023 dibandingkan US$1,04 miliar pada tahun 2022. EBITDA perseroan turun dari US$1,59 miliar pada tahun 2022 menjadi US$1,25 miliar pada tahun 2023.

PT Medco Energy International Tbk membukukan laba sebesar US$345,76 juta pada tahun 2023, turun 37,29 persen dari tahun 2022 sebesar US$551,41 juta.

Menurut perkiraan Medco, tergantung pada dampaknya terhadap harga komoditas, laba bersih sebelum bunga, pajak, depresiasi dan amortisasi (EBITDA) akan menurun pada tahun 2023 dibandingkan tahun 2022. Selain itu, kontribusi laba bersih Amman Minerals International (AMMN) menurun akibat hujan lebat dan tertundanya izin ekspor.

Dengan demikian, laba per saham dasar yang dapat diatribusikan kepada pemilik entitas induk akan meningkat dari US$0,02123 pada tahun 2022 menjadi US$0,01321 pada tahun 2023.

Pada 2023, saham perseroan meningkat 16,02 persen menjadi US$ 2,02 miliar. Pada periode yang sama tahun lalu, saham perusahaan dikatakan sebesar $1,74 miliar. Liabilitas perusahaan meningkat 99,8 persen dari $5,18 miliar pada tahun 2022 menjadi $5,44 miliar pada tahun 2023.

Aset perseroan tercatat sebesar US$7,46 miliar pada 2023, meningkat 7,73 persen dari periode yang sama tahun lalu sebesar US$6,93 miliar. Perseroan akan memperoleh pendapatan tunai dan setara kas sebesar US$353,94 juta pada tahun 2023.

Sementara pada tahun 2024, perseroan mempersiapkan belanja modal migas tahun 2024 dengan fokus pengembangan pengeboran Natuna, Koridor, dan OMAN 60. 17 persen untuk pasar dan ekspor. Sedangkan kontrak produksi Netuna bernilai sekitar 200 BBTUD dan 100 persen untuk ekspor.

Sedangkan belanja modal Medco Power untuk Fasilitas Pengembangan Panas Bumi Ijen dan PLTS Bali sebesar US$80 juta.

bachkim24h.com, Jakarta – Selama bulan suci Ramadhan, umat Islam di seluruh dunia berpuasa dengan shalat Tarawih. Sholat Tarawih merupakan salah satu salat sunnah yang dilakukan setelah salat malam. Artikel ini membahas tentang niat salat tarawih, cara menunaikannya, dan shalat wajib.

Niat Sholat Tarawih merupakan langkah awal sebelum menunaikan Ibadah. Niat ini hendaknya dilakukan dengan sepenuh hati dan penuh kesadaran. Niat salat tarawih dapat dibaca secara lisan. Misalnya, “Demi Allah, saya ingin shalat Tarawih dua belas rakaat Sunnah Mu’akkad.”

Dengan memahami niat shalat tarawih, tata cara pelaksanaannya, serta shalat-shalat yang dianjurkan, maka kita dapat melaksanakan shalat tarawih dengan lebih baik. Di bawah ini niat salat Tarawih berjamaah atau sendiri pada Senin 11 Maret 2024 diambil dari situs online NU.

A

Ushalli sunnah tarawihi rakataini mustaqbilal qiblati adaan iman lillahi ta’ala.

Artinya: Demi Allah, sebagai imam, saya niat salat sunah tarawih dua rakaat menghadap kiblat.

2. Niat (maqmoom) shalat tarawih berjamaah.

A

Ushalli sunnah tarawihi rak’taini mustaqilal qiblati ad’an ma’muman lillahi ta’ala.

Artinya: Saya ingin shalat sunnah tarawih dua rakaat menghadap kiblat sebagai pahala di sisi Allah subhanahu wa ta’ala. 3. Niat Sholat Tarawih

A

Ushalli sunnah tarawihi rakataini Mustaqbilal qiblati adaan lillahi ta’ala.

Artinya : Demi Allah, saya niat salat sunah tarawih dua rakaat menghadap kiblat.

Setelah menetapkan niat, langkah selanjutnya adalah mempersiapkan salat Tarawih. Caranya adalah bersih-bersih, berwudhu, memakai pakaian yang bersih. Setelah itu, kita bisa menyiapkan tempat salat tarawih yang nyaman di rumah atau di masjid.

Tata cara shalat Tarawih adalah 11 rakaat. Setiap rakaat dilakukan dengan membaca surat al-Fatihah dan surat-surat pendek lainnya. Setelah salat dua atau empat rakaat, kita istirahat sejenak dan melanjutkan dua hingga empat rakaat berikutnya.

Setelah salat tarawih delapan rakaat, kita mendengarkan ceramah atau di banyak masjid kita langsung salat witir tiga rakaat.

Doa yang dipanjatkan dalam shalat tarawih adalah doa umum dan doa khusus. Doa yang umum adalah mohon ampun, rahmat dan hidayah dari Allah subhanahu wa ta’ala. Selain itu, kita hendaknya mendoakan kekuatan untuk berpuasa di bulan Ramadhan.

Doa khusus yang dipanjatkan dalam shalat tarawih adalah doa permohonan dan ampunan. Kita bisa berdoa semoga Allah subhanahu wa ta’ala menerima segala ibadah yang telah kita lakukan dan kita akan mendapatkan pahala yang banyak. Kita juga bisa memohon kekuatan untuk terus istikamah dalam beribadah selama bulan Ramadhan.

Kita juga hendaknya rendah hati dan sederhana dalam membaca doa tarawih. Khusuk adalah keadaan hati yang penuh perhatian, dan khushu adalah keadaan hati yang beriman dan taat kepada Allah subhanahu wa ta’ala. Hendaknya kita menjauhi segala gangguan dan fokus pada ibadah yang kita lakukan.

Selain itu, kita harus menjaga privasi kita dengan tidak berbicara selama shalat tarawih kecuali dalam keadaan darurat. Kita juga harus menjaga kerendahan hati dan saling menghormati di antara orang-orang yang berdoa.

Dalam shalat Tarawih, Anda dapat memperbanyak bacaan Al-Qur’an di antara setiap rakaat. Hal ini dapat menambah keberkahan ibadah kita. Selain itu, setelah selesai shalat tarawih kita bisa memperbanyak dzikir dan doa.

Sholat tarawih di bulan Ramadhan sangat dianjurkan. Melalui ibadah ini kita bisa mendekatkan diri kepada Allah subhanahu wa ta’ala dan mendapat banyak keberkahan.